WTI Crude - Still Looking for the Correction to Extend

rhboskres

Publish date: Thu, 18 Jun 2020, 07:08 PM

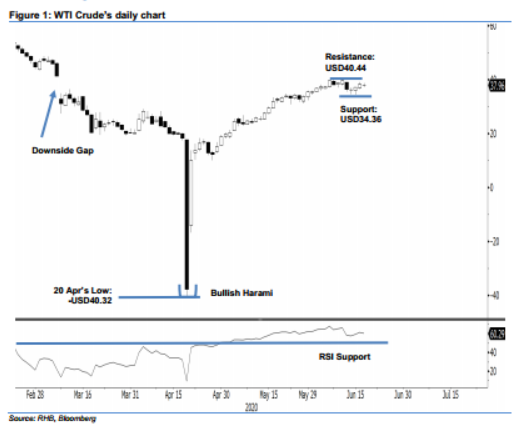

Tag the possible retracement leg; maintain short positions. The WTI Crude ended the latest trade USD0.42 lower at USD37.96. Despite the commodity’s prior sharp rebound over two sessions – off the USD34.36 low – we see this as just a rebound within the correction leg that started from the recent USD40.44 high. This retracement phase is meant to correct the WTI Crude’s multi-week sharp upward move following 20 Apr’s historic negative pricing. We maintain our negative trading bias.

On the bias – based on the daily chart – that the price risk is tilted towards the downside, we recommend traders stay in short positions. We initiated these at USD36.34, or the closing level of 11 Jun. To manage the risk, a stoploss can be placed above the USD40.44 mark.

The immediate support is revised to USD36.50, ie price point of 16 Jun. This is followed by the USD34.36 level – the low of 15 Jun. Meanwhile, the immediate resistance is maintained at the USD38.50 mark and followed by the USD40.44 level, which was the hig

Source: RHB Securities Research - 18 Jun 2020

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)