E-Mini Dow: Hitting the 200-Day SMA Wall Again

rhboskres

Publish date: Wed, 08 Jul 2020, 10:31 PM

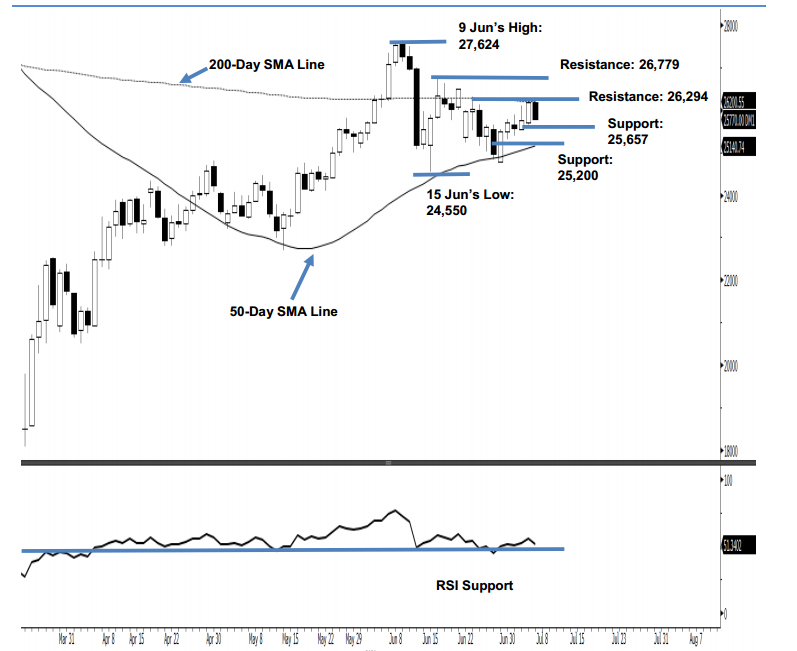

Maintain short positions. The E-mini Dow attempted to cross the 200-day SMA line for a second consecutive session, but failed. The session witnessed the index reaching a 26,280-pt high before sliding lower to close 409 pts weaker at 25,770 pts. The E-mini Dow’s failure to cross the aforementioned SMA line is dampening the possibility of a deeper rebound taking place. Looking at the broader picture, the correction phase that started from the high of 27,624 pts on 9 Jun remains valid. Consequently, we maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at 25,165 pts, which was the closing level of 11 Jun. For risk-management purposes, a stop-loss is recommended above the 26,294-pt mark.

The immediate support is revised to 25,657 pts, which was the low of 6 Jul. This is followed by 25,200 pts. Towards the upside, the immediate resistance is eyed at 26,294 pts – the high of 23 Jun – and followed by 26,779 pts, ie the high of 16 Jun

Source: RHB Securities Research - 8 Jul 2020