WTI Crude: Still Looking for Correction Phase to Extend

rhboskres

Publish date: Thu, 16 Jul 2020, 05:21 PM

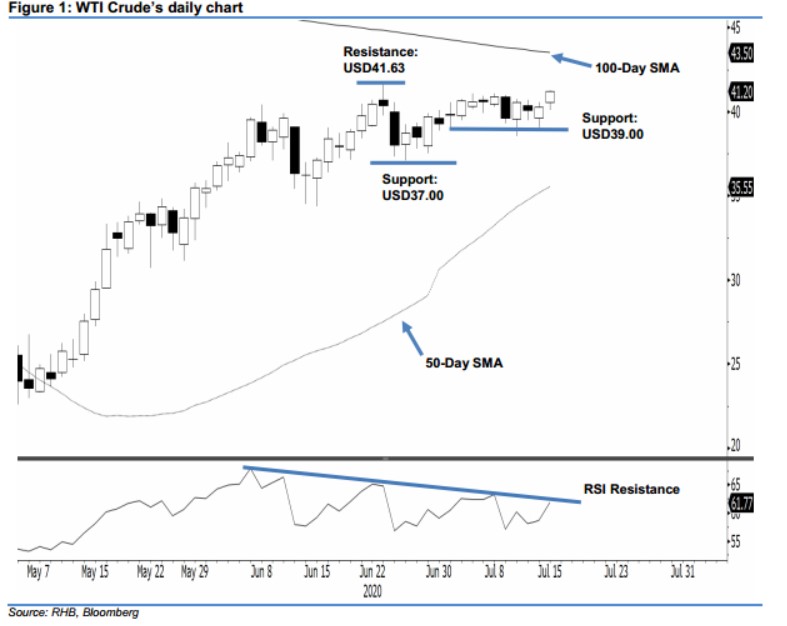

Maintain short positions. The WTI Crude extended its rebound for the second consecutive session, after it came close to testing the USD39.00 support level two sessions ago. At close, the commodity was at USD41.20, indicating a USD0.91 gain. Still, we believe the commodity is likely trading in a correction phase after hitting a high of USD41.63 on 23 Jun. This phase is meant to correct the commodity’s previous multi-week sharp upward move. We maintain our negative trading bias.

We keep our recommendation for traders to stay in short positions, which we initiated at USD39.62 – the closing level of 9 Jul. To manage risks, a stop-loss can be placed above USD41.63.

We maintain the immediate support at USD39.00, near 1 Jul’s low. This is followed by USD37.00, which is close to the low of 18 Jun. Meanwhile, the immediate resistance is now eyed at USD41.63 – the high of 23 Jun. This is followed by USD43.50, which is near the 100-day SMA line

Source: RHB Securities Research - 16 Jul 2020