Hang Seng Index Futures: FKLI: Moving Down the Trailling-Stop

rhboskres

Publish date: Wed, 05 Aug 2020, 12:57 AM

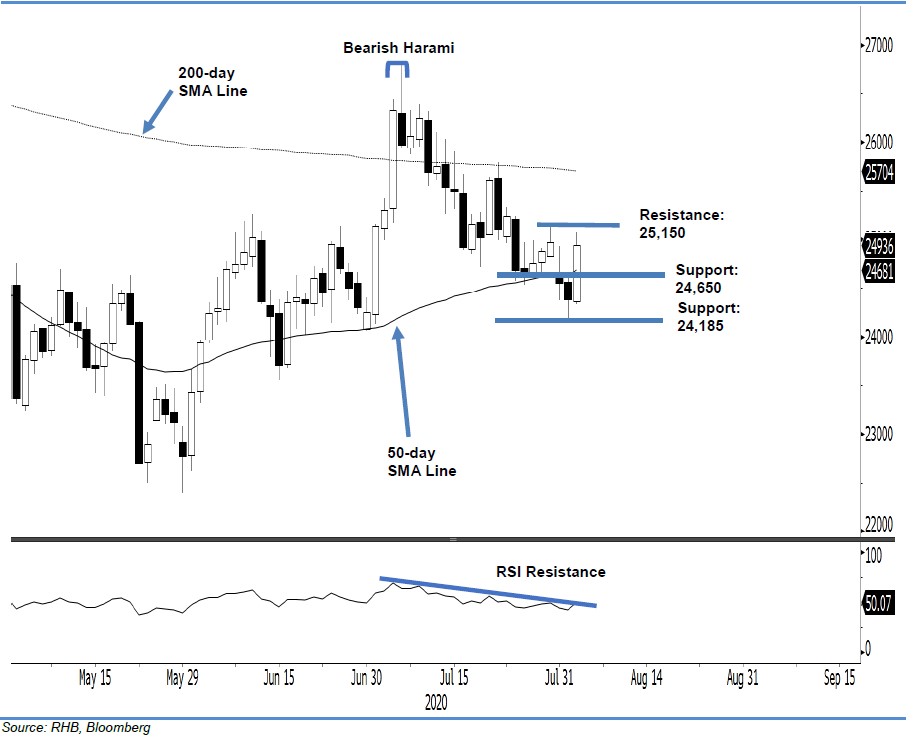

Maintain short positions with a lower trailling-stop. The HSIF formed a white candle to cross above the 50-day SMA line, which was marginally breached during the prior two sessions. The index settled 549 pts higher at 24,936 pts after reaching a high of 25,068 pts. The positive session can be seen as a possible early sign that the HSIF’s 1-month retracement phase may have reached an end. However, to confirm this, we believe the index has to cross above 25,150 pts in the coming sessions. Until this happens, we are keeping to our negative trading bias.

We recommend traders stay in short positions. We initiated these at 24,920 pts, ie the closing level of 16 Jul. For risk-management purposes, a stop-loss can now be placed above 25,150 pts.

The immediate support is revised to 24,650 pts, which is near the 50-day SMA line. This is followed by 24,185 pts, or the low of 3 Aug. Conversely, the immediate resistance is now seen at 25,150 pts – a level near 30 Jul’s high – and followed by 25,500 pts.

Source: RHB Securities Research - 5 Aug 2020