WTI Crude - First Taste of the 200-Day SMA Line

rhboskres

Publish date: Thu, 06 Aug 2020, 06:23 PM

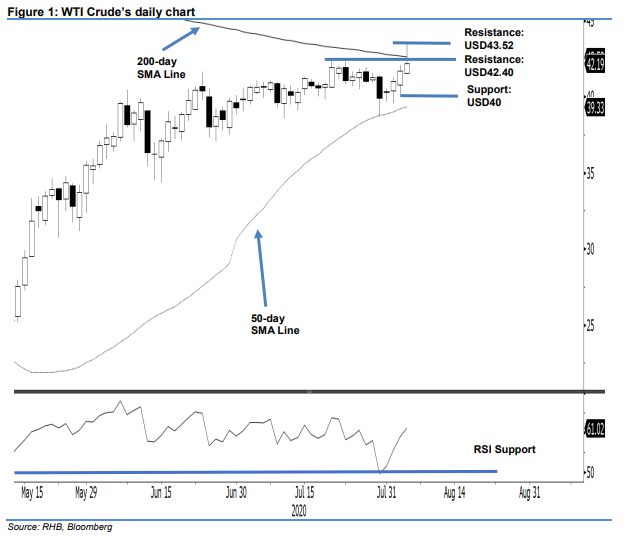

Maintain long positions. For the first time, the WTI Crude tested the 200-day SMA line after it was breached in February. The commodity hit a high of USD43.52 before sliding back to close at USD42.19 – below the said SMA line. At this juncture, it is too early to suggest that the commodity has been rejected from the said SMA line, and that a retracement phase is imminent. To confirm a possible price rejection, based on the latest technical picture, we believe the USD40 support threshold would need to be breached by the bears. Until this happens, we are keeping our positive trading bias.

We advise traders to stay in long positions, which we initiated at USD41.96 – the closing level of 21 Jul. To manage risks, a stop-loss can be placed below the USD40 mark.

The immediate support is revised to USD41.30, which is near the latest low, followed by the USD40 round figure. Conversely, the immediate resistance is pegged at USD42.40, or the high of 21 Jul. This is followed by USD43.52, which is derived from the latest high.

Source: RHB Securities Research - 6 Aug 2020