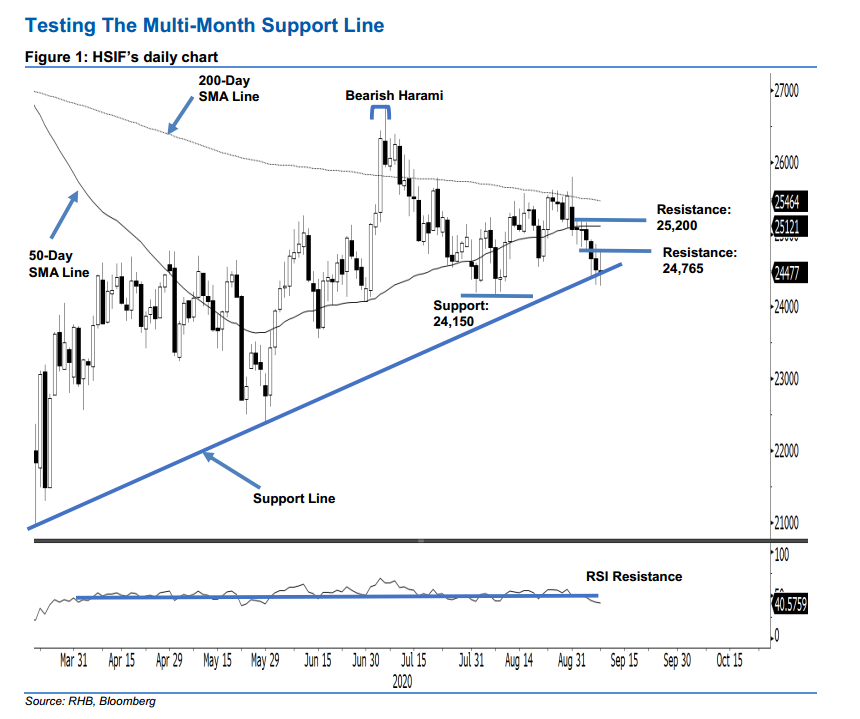

Hang Seng Index Futures - Testing the Multi-Month Support Line

rhboskres

Publish date: Wed, 09 Sep 2020, 06:41 PM

Maintain short positions. The HSIF experienced a relatively wide trading range of 24,280 pts and 24,765 pts, before closing the day 39 pts lower at 24,477 pts. The index has been testing the multi-month support line (as drawn in the chart) over the latest two sessions. A downside breach of this line would be technically negative and would, at the minimum, see the support zone of 24,000-24,150 pts be tested. The ongoing retracement phase started after the index failed to cross above the 200-day SMA line recently. Maintain our negative trading bias.

In the absence of a price reversal signal, we advise traders to stay in short positions. We initiated these at 24,924 pts, which is the closing level of 3 Sep. For risk-management purposes, a stop-loss can be placed above the 25,200-pt level.

Support levels are eyed at 24,150 pts , the low of 7 Aug. This is followed by the 24,000-pt round figure. Conversely, the immediate resistance is marked at 24,765 pts, followed by 25,200-pt.

Source: RHB Securities Research - 9 Sept 2020