Hang Seng Index Futures - Risk for Further Retracement Remains High

rhboskres

Publish date: Mon, 21 Sep 2020, 01:03 PM

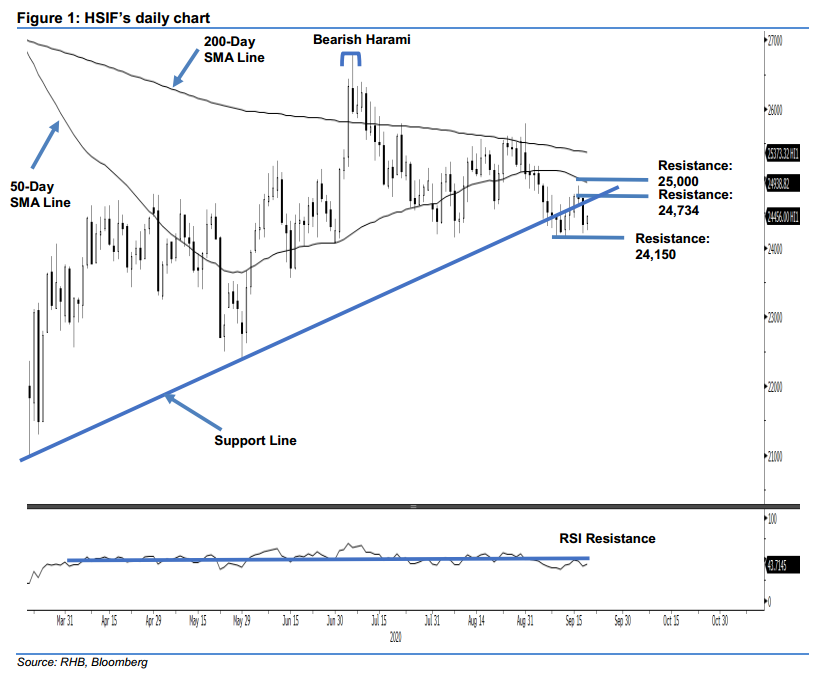

Maintain short positions. The HSIF staged a positive intraday price reversal, rebounding from a low of 24,250 pts to settle the session 122 pts higher at 24,456 pts. The positive session came following the prior two sessions’ retracements, after the index came in near to testing the 50-day SMA line. Additionally, the HSIF is still sitting below the multi-month support line ( as drawn in the chart). All in, the index’s retracement phase has yet to show signs of hitting an end despite the latest positive performance. Hence, we are keeping to our negative trading bias.

We advise traders to stay in short positions. We initiated these at 24,924 pts, which was the closing level of 3 Sep. For risk-management purposes, a stop-loss can be placed above the 25,200-pt mark.

The support level is set at 24,150 pts, ie the low of 7 Aug. This is followed by the 24,000-pt round figure. Moving up, the immediate resistance is set at 24,734 pts and followed by the 25,000-pt level.

Source: RHB Securities Research - 21 Sept 2020