Hang Seng Index Futures - a Stronger Rebound May be Developing

rhboskres

Publish date: Wed, 07 Oct 2020, 04:43 PM

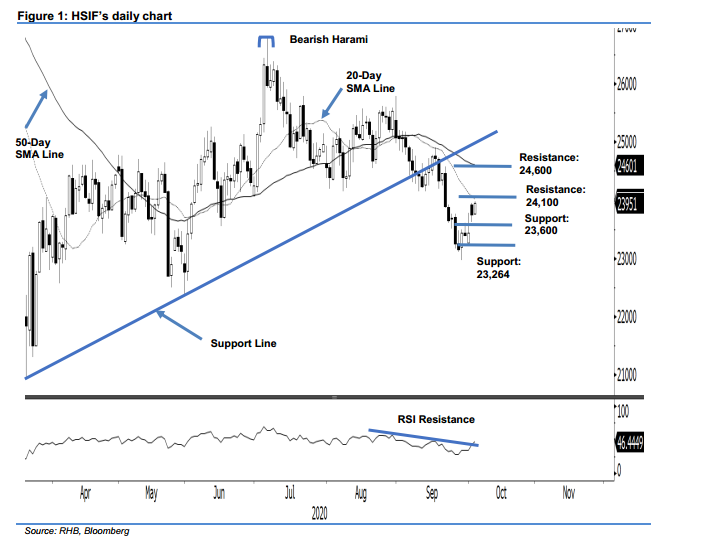

Initiate long positions. The HSIF advanced 196 pts to settle at 23,951 pts, slightly below the 24,000-pt round figure. With the latest positive performance, chances are high that the index is in the process of developing a stronger rebound after it reached a low of 22,964 pts on 28 Sep. Towards the upside, there is a fair chance for it to advance towards the 24,500-pt area, ie a price point within the resistance zone made up of the 20- and 50-day SMA lines. Note that the RSI has also crossed above the resistance line (as drawn in the chart), despite it is still being below the neutral reading. Switch our trading bias from negative to positive.

Our previous short positions initiated at 24,924 pts, which was the closing level of 3 Sep, were closed out at 23,771 pts in the latest session. Concurrently, we initiate long positions. For risk-management purposes, a stop-loss can be placed below 23,500 pts.

The immediate support is revised to 23,600 pts, followed by 23,264 pts, which is the low of 30 Sep. Moving up, the immediate resistance is maintained at 24,100 pts, ie near the 20-day SMA line, followed by 24,600 pts, near the 50- day SMA line.

Source: RHB Securities Research - 7 Oct 2020