Hang Seng Index Futures - Testing the 50-Day SMA Line

rhboskres

Publish date: Thu, 15 Oct 2020, 04:28 PM

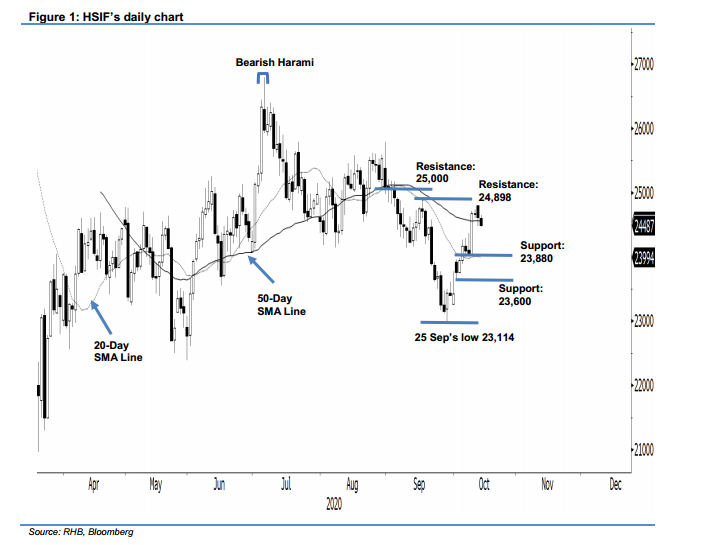

Maintain long positions. The HSIF paused the uptrend, closing 218 pts weaker during the latest candle. The index started the day’s session at 24,794 pts and moved higher towards the 24,800-pt session high, before retracing to a session low of 24,475 pts. During the night session, the HSIF tried to pull up, opening at 24,606 pts, but faltered to a session low of 24,463 pts – the last trade was at 24,488 pts. We believe the latest price action did not flash out any selling signal or exhaustion of uptrend – but was merely a consolidation while testing the 50-day SMA line. As mentioned on the previous report, we do expect a wider trading range. As long the support level is not breached, the uptrend will remain. Hence, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at 23,951 pts, or the closing level of 6 Oct. For riskmanagement purposes, the stop-loss level can be placed higher at 23,880 pts, which was the day’s low on 7 Oct.

The immediate support level is marked at 23,880 pts, followed by the 23,600-pt mark. On the upside, the immediate resistance will be the day high of 16 Sep at 24,898 pts – followed by 25,000 pts, ie the round figure.

Source: RHB Securities Research - 15 Oct 2020