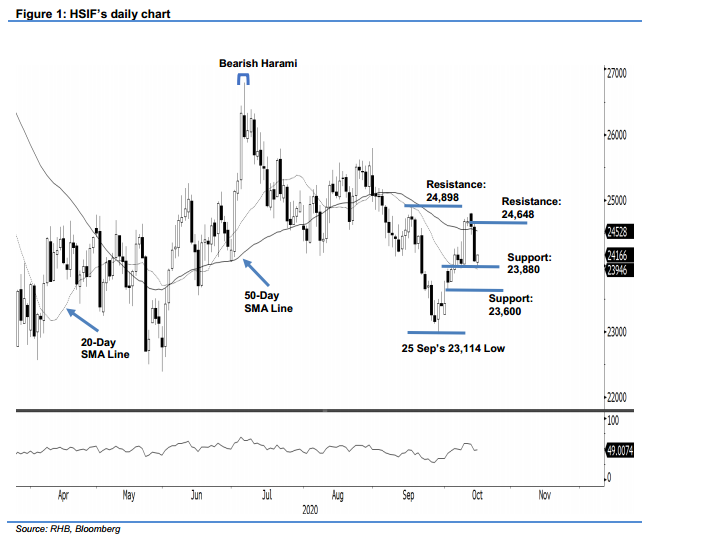

Hang Seng Index Futures - Rejected From the 50-Day SMA Line

rhboskres

Publish date: Fri, 16 Oct 2020, 06:02 PM

Maintain long positions. The HSIF has sold down from the 50-day SMA line, closing 446 pts lower vis-à-vis the previous session. The index started the day’s session at 24,480 pts – briefly trading at the 24,565-pt session high – before correcting 483 pts to a session low of 24,057 pts. During the night session, the HSIF pared some of the losses that occurred during the morning session, opening at 24,082 pts to touch the session low at 23,982 pts. It rebounded 182 pts to the evening session’s 24,164-pt high – the last trade was at 24,162 pts. Just like what we had predicted – a wide trading range – we saw a 580-pt movement, ie the difference of the session’s high and low of 24,565 pts and 23,982 pts. We are now expecting some buying interest to emerge near the support level, or somewhere close to the 20-day SMA line. Despite the weak price action, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these positions at 23,951 pts, or the closing level of 6 Oct. For risk-management purposes, a stop-loss level is marked at 23,880 pts, ie the day’s low on 7 Oct.

The immediate support level is earmarked at 23,880 pts and followed by the 23,600-pt mark. On the upside, the immediate resistance is eyed at 15 Oct’s day high – 24,648 pts – and followed by 24,898 pts

Source: RHB Securities Research - 16 Oct 2020