FKLI - Falling Back into The 1,500-1,515-Pt Zone

rhboskres

Publish date: Fri, 16 Oct 2020, 06:08 PM

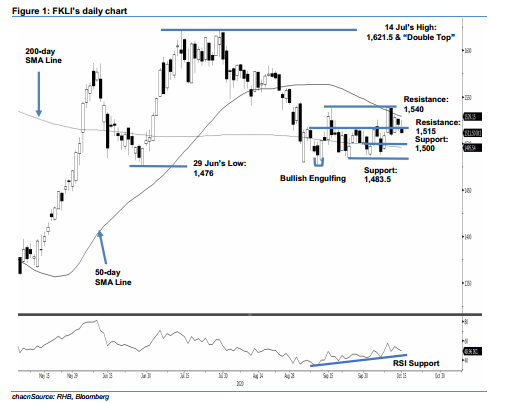

Maintain short positons. The FKLI softened 9 pts to close at 1,511.5 pts after failing to hold on to its earlier session’s positive posture, where it reached a high of 1,525.5 pts. The closing level placed the index back into the resistance zone of 1,500-1,515 pts. We continue to take the view that the index’s multi-week counter-trend rebound, which started from 11 Sep’s “Bullish Engulfing” pattern, ended after it was rejected from the 50-day SMA line recently. In a bigger picture, the index is likely in the process of extending its correction phase that started from end-Jul’s “Double Top” formation. A downside breach of the 200-day SMA line would confirm our thesis. Maintain our negative trading bias.

We recommend that traders stick to short positons. We initiated these at 1,510 pts, the closing level of 12 Oct. To manage risks, a stop-loss can be placed above 1,540 pts.

The immediate support is revised to 1,500 pts, followed by 1,483.5 pts – the low of 24 Sep. Conversely, the immediate resistance is now set at 1,515 pts, followed by 1,540 pts.

Source: RHB Securities Research - 16 Oct 2020