WTI Crude: Still Pausing Around the 50-Day SMA Line

rhboskres

Publish date: Tue, 20 Oct 2020, 10:58 AM

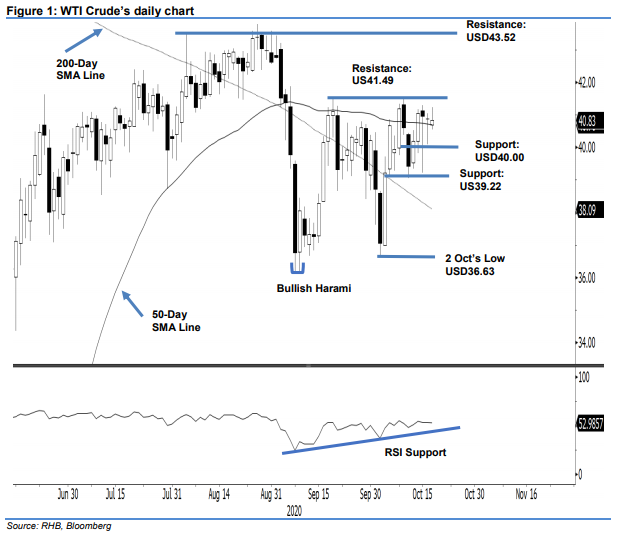

Maintain long positions. The WTI Crude ended its latest session marginally lower by USD0.05 to close at USD40.83. This was despite the healthy intraday swing, with the low and high posted at USD40.54 and USD41.22. The commodity has managed to hold around the 50-day SMA line over the recent sessions. This signals that the WTI Crude is likely in the process of developing a base for its next attempt for a firm breakout from said SMA line. Towards the upside, we still believe the USD41.49 immediate resistance to be at least be re-tested going forward and maintain our positive trading bias.

As the rebound is still likely to extend, we recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed below the USD40.00 mark.

The immediate support is kept at the USD40.00 round figure and followed by USD39.22. Meanwhile, the immediate resistance is eyed at 18 Sep’s high of USD41.49 and followed by the USD42.00 level.

Source: RHB Securities Research - 20 Oct 2020