Hang Seng Index Futures - Attempting to Flip Above the 50-day SMA Line

rhboskres

Publish date: Wed, 21 Oct 2020, 04:46 PM

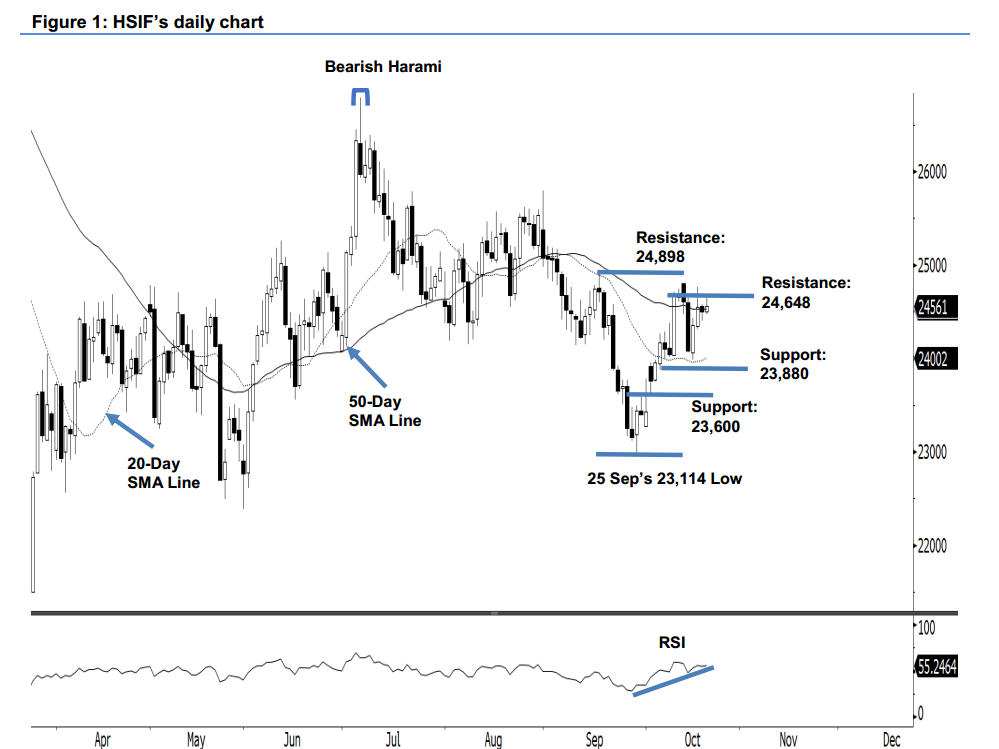

Maintain long positions. The HSIF rose 157 pts higher to close at 24,561 pts – it is attempting to close above the 50-day SMA line again. The index started the session at 24,487 pts, testing the session low at 24,413 pts before recouping 89 pts to close at 24,502 pts. During the night session, the HSIF continued to move sideways, starting the session at 24,503 pts and testing the session’s low of 24,466 pts. Towards the late session, the bulls charged 176 pts to touch the session high at 24,642 pts. From the daily chart, we can see that the 20-day SMA line is curving higher, indicating a bullish sentiment ahead. Furthermore, the RSI trend is above the 50% threshold, indicating a higher possibility of punching through the 50-day SMA line. Premised on this, we maintain our positive trading bias.

We recommend that traders maintain long positions. We initiated these positions at 23,951 pts, or the closing level of 6 Oct. For risk-management purposes, the stop-loss is set at 23,880 pts, ie 7 Oct’s day low.

The immediate support level kept at 23,880 pts and followed by the 23,600-pt mark. On the upside, the immediate resistance is eyed at 15 Oct’s day high of 24,648 pts, and followed by the 24,898-pt mark.

Source: RHB Securities Research - 21 Oct 2020