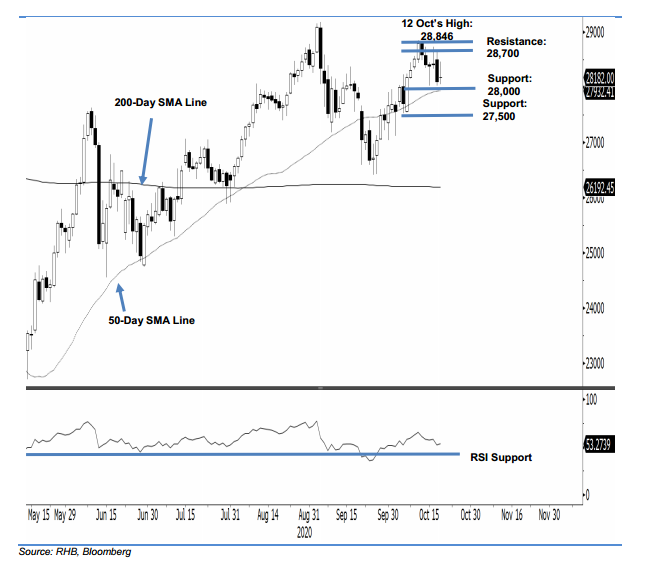

E-Mini Dow - Pausing Near the 50-Day SMA Line

rhboskres

Publish date: Wed, 21 Oct 2020, 05:02 PM

Maintain short positions. The E-Mini Dow ended the latest session with an indecisive “Doji” formation – this was after reaching a low and high of 28,048 pts and 28,466 pts – before ending 82 pts higher at 28,182 pts. Said formation, which appeared near the rising 50-day SMA line, suggests the bears are likely taking a pause after the prior session’s decline. Broadly, we are seeing the index trading in an incomplete correction phase, which set in after it reached a possible rebound interim high of 28,846 pts on 12 Oct. Towards the downside, we are forecasting for the E-mini Dow to slide towards 27,500-pt area. We maintain our negative trading bias.

In the absence of price reversal signals, we recommend traders stay in short positions. We initiated these at 28,100 pts, which was the closing level of 19 Oct.

The immediate support is maintained at the 28,000-pt round figure, which was also near 15 Oct’s low. This is followed by 27,500 pts. Meanwhile, the immediate resistance is eyed at the 28,500-pt mark and followed by 28,700 pts – a price point for 16 Oct.

Source: RHB Securities Research - 21 Oct 2020

.png)