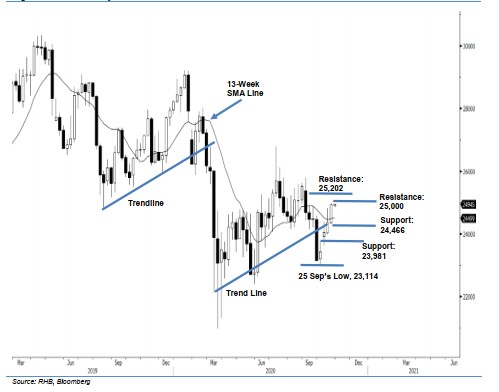

Hang Seng Index Futures- Weekly Chart Shows the Bulls in Control

rhboskres

Publish date: Tue, 27 Oct 2020, 10:34 AM

Maintain long positions. On the weekly basis, the HSIF closed at 24,945 pts – piercing above the 13-week SMA line. The index started the week at 24,500 pts, trading briefly at the week’s low of 24,404 pts and surging towards the week’s high at 24,967 pts. Since 25 Sep, we have been witnessing a strong counter-trend upward move, and the HSIF is on the way to test the 25,000-pt round number resistance. As the index is trading above the 13-week SMA line, we believe this may further strengthen the medium-term outlook towards a bullish bias. Meanwhile, the HSIF also clawed above the trend line that started since September’s low – a strong support level is seen at 24,466 pts. As long as the technical lows are rising and remain intact, we keep to our positive trading bias.

We recommend traders maintain long positions. We initiated these at 23,951 pts, or the closing level of 6 Oct. For risk-management purposes, the stop-loss is set at 24,466 pts, which was 21 Oct’s day low.

The immediate support is pegged at 24,466 pts and followed by the 23,981-pt mark. On the upside, the immediate resistance is sighted at the 25,000-pt round number, which is followed by the 25,202-pt threshold

Source: RHB Securities Research - 27 Oct 2020