E-Mini Dow- 200-Day SMA Retest – Possibility Getting Higher

rhboskres

Publish date: Wed, 28 Oct 2020, 06:30 PM

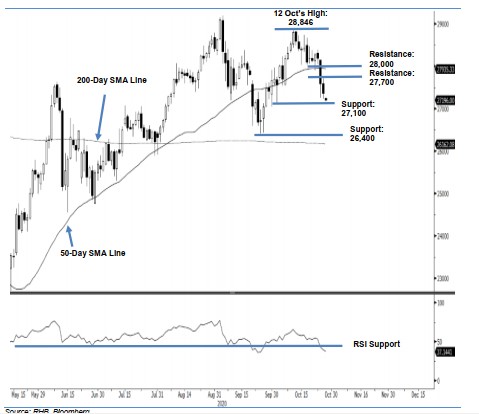

Maintain short positions. The E-Mini Dow continued to extend its retracement after recently breaching below the 50-day SMA line. It settled 216 pts lower yesterday at 27,365 pts after failing to sustain its earlier session’s positive momentum, which saw prices hitting a 27,713-pt high. The correction is now deeper than our minimum target of reaching the 27,500-pt mark. Based on the price pattern that has been in development since early September, chances are getting increasingly higher of the retracement’s current leg seeing the index retesting the 200-day SMA line. This is further supported by the RSI, which continues to slide lower – below the 50 neutral reading – but has yet to reach the oversold threshold. Hence, we are keeping to our negative trading bias.

We recommend traders stay in short positions. We initiated these at 28,100 pts, which was the closing level of 19 Oct. To manage risks, a stop-loss can be placed above the 28,400-pt threshold.

The immediate support is revised to 27,100 pts – a price point near the 2 Oct low. This is followed by 26,400 pts, which was near the low of 24 Sep. Meanwhile, the immediate resistance is revised to 27,700 pts, ie near the latest high. This is followed by the 28,000-pt round figure.

Source: RHB Securities Research - 28 Oct 2020