FKLI - Consolidates Near 1,600 Pts

rhboskres

Publish date: Thu, 19 Nov 2020, 05:58 PM

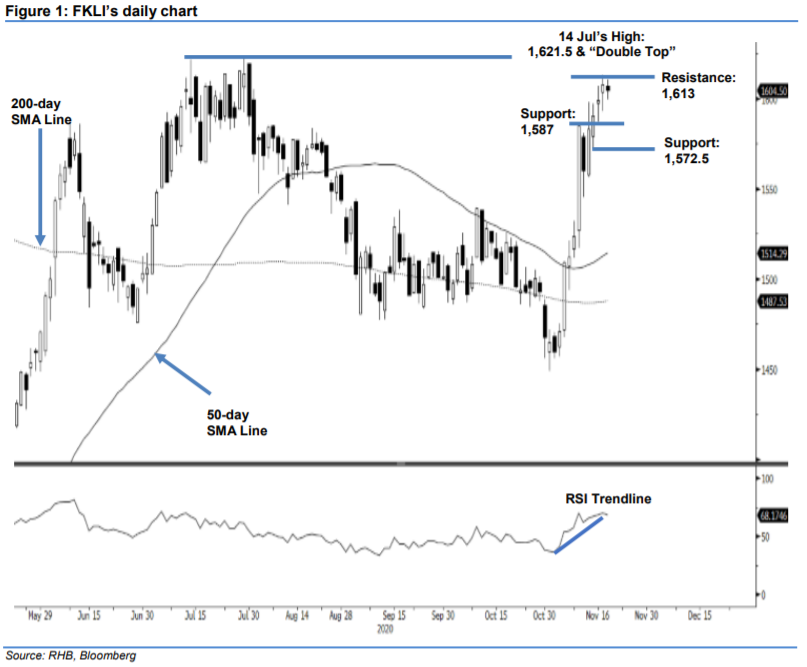

Maintain long positions. The FKLI managed to find its footing above 1,600 pts despite falling 3.5 pts to settle at 1,604.5 pts yesterday. It opened flat at 1,607 pts, bouncing between the high of 1,610.5 pts and low of 1,599.5 pts before settling at 1,604.5 pts. Based on the last three sessions’ price actions, we can see that the index is trading between the band of 1,613 pts and 1,587 pts. An upside breakout of the boundary will see the index test the high of the Double Top. Any minor pullback or retracement will provide an opportunity for the bulls to ride on the uptrend. With the RSI pointing upwards indicating an intact bullish momentum, we maintain a positive trading bias.

We recommend that traders remain in long positions. We initiated these at 1,590.5 pts, the closing level of 13 Nov. To manage risks, we place our stop-loss below 1,572.5 pts.

The immediate support is unchanged at 1,587 pts, followed by the low of 13 Nov, ie 1,572.5 pts. Towards the upside, the immediate resistance is pegged at recent high of 1,613 pts, followed by the Double Top at 1,621.5 pts.

Source: RHB Securities Research - 19 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024