WTI Crude - Trading in An Incomplete Correction Phase

rhboskres

Publish date: Fri, 20 Nov 2020, 05:46 PM

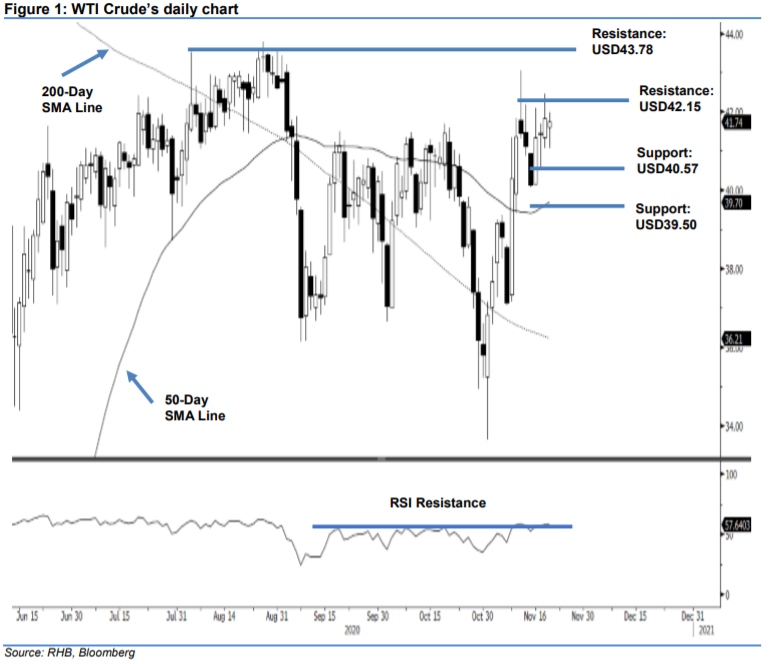

Maintain short positions. The WTI Crude narrowed its losses to USD0.08, closing at USD41.74. This was after it reached a low of USD41.08 – matching the low of the prior session. Our expectation for the commodity to retrace towards the 200-day SMA line in the coming sessions, at the minimum, remains unchanged. This is on the basis that the correction pattern that started to develop from the high of 11 Nov remains incomplete. The correction phase set in after the black gold experienced a relatively sharp 1.5 weeks upward move from the low of USD33.64 recorded on 2 Nov. Maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD40.13, or the closing level of 13 Nov. To manage risks, a stop-loss can be placed above the USD43.78 threshold.

We maintain our support level targets at USD40.57, being 17 Nov’s low. This is followed by USD39.50, which is near the 50-day SMA line. A resistance point is maintained at USD42.15 and followed by USD43.78 – the high of 26 Aug.

Source: RHB Securities Research - 20 Nov 2020