WTI Crude - Struggling Near the USD60.00 Psychological Level

rhboskres

Publish date: Mon, 22 Mar 2021, 08:55 AM

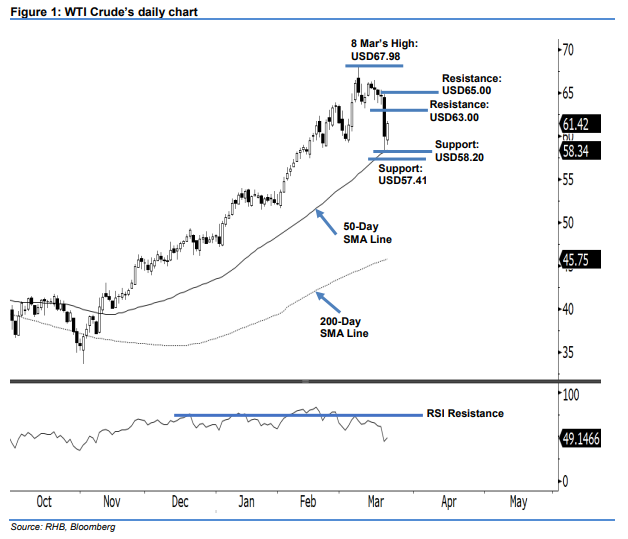

Maintain short positions. The WTI Crude saw a strong rebound last Friday, gaining USD1.42 to settle at USD61.42. The commodity opened at USD59.56 and traded sideways for most of the session. Coming into the US trading hours, it fell to the session’s low of USD58.94 before climbing towards the high of USD61.72. It was last traded at USD61.42. Based on Friday’s price actions, the commodity has managed to pierce into the bearish candle left by the massive sell-off on Thursday. If the positive price actions follow through on Monday, the commodity may test the resistance levels of USD63.00 and USD65.00. However, if it fails to retain the USD58.20 support level, a deeper correction is expected in coming sessions. As the RSI is below the 50% threshold, and the momentum is weakening, we maintain our negative trading bias until the stop-loss is breached.

We recommend traders shift over to short positions, initiated at USD60.06 or the closing level of 18 Mar. To manage risks, a stop-loss can be set above USD65.00.

Support levels are marked at USD58.20, or 18 Mar’s low, followed by USD57.41, which was derived from 12 Feb’s low. On the upside, the immediate resistance is pegged at USD63.00, followed by USD65.00.

Source: RHB Securities Research - 22 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024