WTI Crude - Consolidates Near the USD60.00 Psychological Level

rhboskres

Publish date: Tue, 23 Mar 2021, 08:56 AM

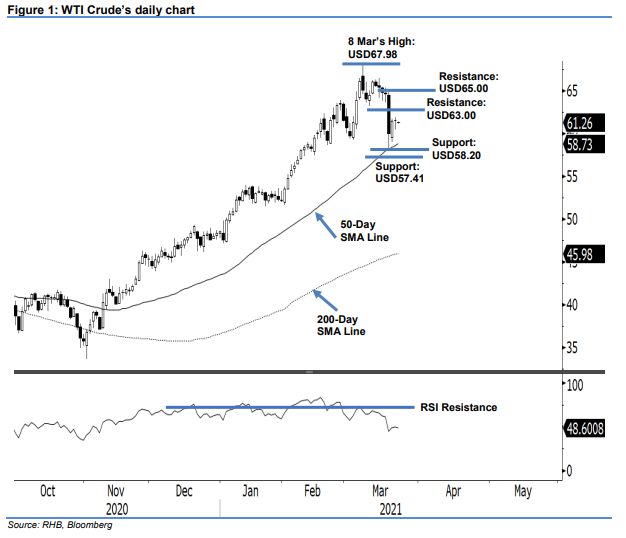

Maintain short positions. The WTI Crude saw selling pressure easing yesterday, gaining USD0.12 to settle at USD61.56. The commodity opened at USD61.60 and fell to the session low of USD60.35. It pared earlier losses during the US trading hours and climbed to the session high of USD62.04 before settling in at USD61.56. With the latest “higher low” pattern formed, the WTI Crude may consolidate and stay above the 50-day SMA line in the coming sessions. As it has yet to to form a “higher high” pattern, coupled with the RSI trending below the 50% threshold, the current correction phase remains intact. As such, we stick to our negative trading bias.

We recommend traders maintain short positions, initiated at USD60.06, or the closing level of 18 Mar. To manage risks, the stop loss is adjusted to USD63.50.

Support levels remain at USD58.20 – 18 Mar’s low – and 12 Feb’ USD57.41 low. On the upside, the immediate resistance is pegged at USD63.00 and followed by USD65.00.

Source: RHB Securities Research - 23 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024