WTI Crude - Falling Below USD60.00 Again

rhboskres

Publish date: Fri, 26 Mar 2021, 05:21 PM

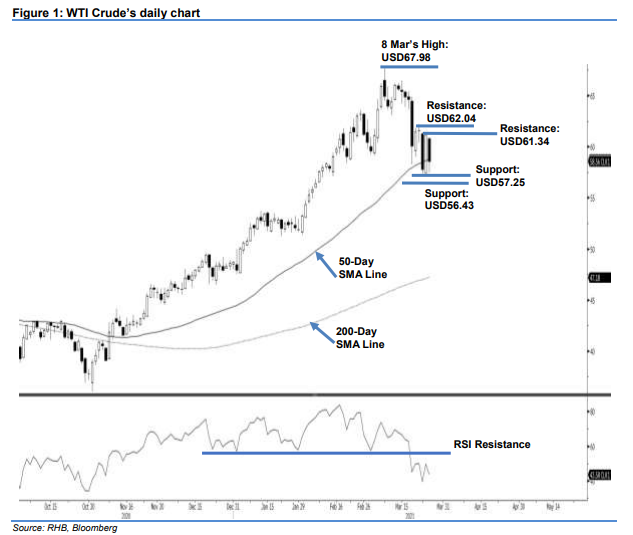

Maintain short positions. After a strong rally during the previous session, the WTI Crude saw profit-taking yesterday, declining USD2.62 to settle at USD58.56. After the commodity started the session at USD60.80, it touched the session high of USD60.86, but failed to advance further and turned south to a session low of USD57.44. The WTI Crude is trading below the USD60.00 physcological level and reverting to a downtrend posture by forming another “lower high” pattern. With the RSI also moving on a downtrend, it is likely that the commodity may retest the USD57.25 low, followed by USD56.43. As such, we maintain our negative trading bias.

We recommend traders to keep to short positions. We initiated this at USD60.06, or the closing level of 18 Mar. To manage risks, the stop loss is revised and placed at USD61.34.

The nearest support level is revised to 23 Feb’s low of USD57.25 and followed by 5 Feb’s USD56.43 low. On the upside, the immediate resistance is revised to 24 Mar’s high of USD61.34 and followed by USD62.04.

Source: RHB Securities Research - 26 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024