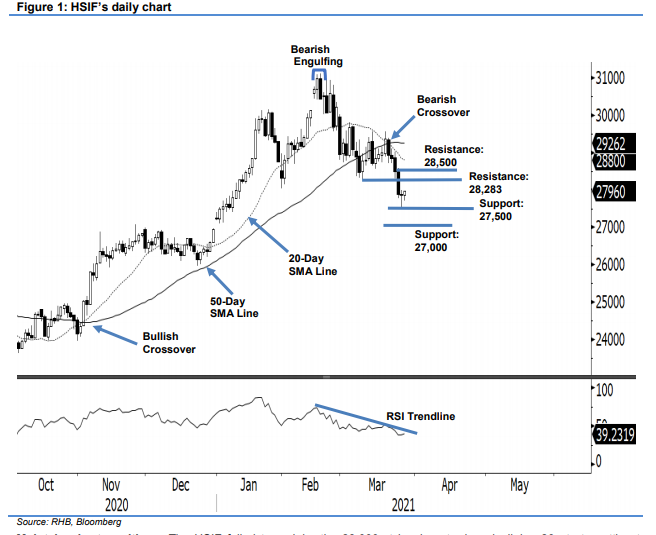

Hang Seng Index Futures - Consolidate Near 28,000 Pts

rhboskres

Publish date: Fri, 26 Mar 2021, 05:25 PM

Maintain short positions. The HSIF failed to reclaim the 28,000-pt level yesterday, declining 23 pts to settle at 27,856 pts. The index started the day session at 27,700 pts, but selling pressure dragged it to a session low of 27,503 pts. Shortly after hitting this low, it saw strong buying interest that pared the earlier losses – it rebounded higher to close at 27,856 pts and formed a Hammer pattern. During the evening session, the HSIF closed at 27,960 pts after testing the 27,964-pt session high. With the formation of a Hammer pattern, we may see buying interest follow through to retest 28,000 pts, followed by the support-turned-resistance level of 28,283 pts. Since the RSI is in oversold territory now, the index is poised to stage a technical rebound. We are keeping to our negative trading bias until the trailing stop is breached.

We recommend traders keep to short positions – this was initiated at 30,077 pts, or the closing level of 22 Feb. For risk-management purposes, the trailing stop is placed at 28,300 pts.

The immediate support level is marked at 27,500-pt round figure and followed by 27,000 pts. Towards the upside, the immediate resistance is seen at 9 Mar’s low of 28,283 pts and followed by the 28,500-pt round figure.

Source: RHB Securities Research - 26 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024