E-Mini Dow - Consolidate Near 32,500 Pts

rhboskres

Publish date: Fri, 26 Mar 2021, 05:26 PM

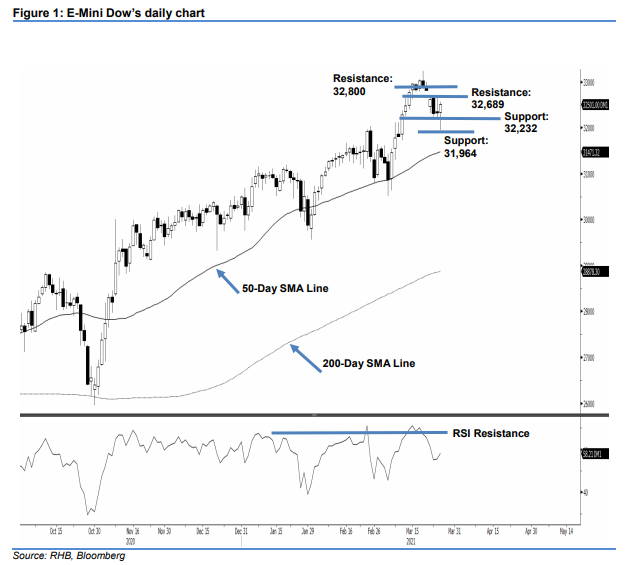

Maintain long positions. The E-Mini-Dow witnessed another volatile session, adding 182 pts to settle at 32,501 pts. The index started the session at 32,338 pts. Tracking its Asian peers, the E-Mini Dow fell to a session low of 31,951 pts. However, it managed to rebound during the US trading hours and reached a 32,569-pt session high before settling in at 32,501 pts – forming a Hammer pattern. Strong buying interest was observed between 32,232 pts and 31,964 pts, ie the long lower shadow. As such, the index should stand firmly on 32,232 pts and retest the 32,629-pt resistance. With the RSI indicator curving up, the bullish momentum is gaining traction. Hence, we maintain our positive trading bias.

We recommend traders stick to long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk-management purposes, the trailing stop is revised to 32,232 pts.

The immediate support is revised to 32,232 pts and followed by 24 Feb’s 31,964-pt high. On the upside, the immediate resistance is revised to 23 Mar’s high of 32,689 pts and followed by the round figure of 32,800 pts.

Source: RHB Securities Research - 26 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024