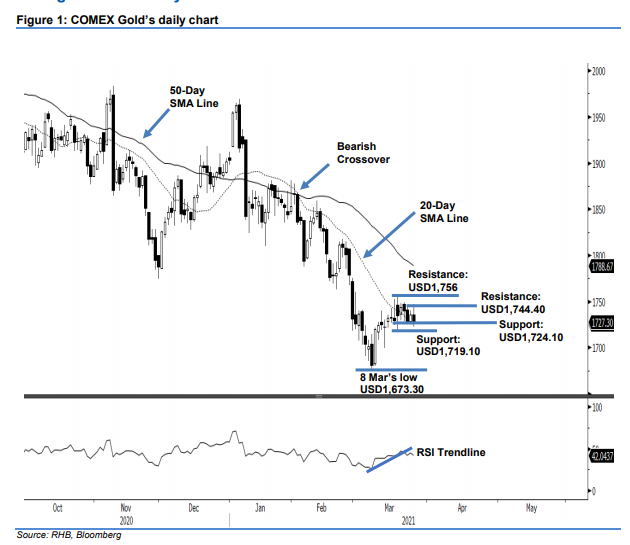

COMEX Gold - Sitting on the 20-Day SMA Line

rhboskres

Publish date: Fri, 26 Mar 2021, 05:28 PM

Maintain long positions. The COMEX Gold failed in its attempt to move higher yesterday, correcting USD8.20 to settle at USD1,727.30. The precious metal started the session at USD1,736 and moved sideways. During the US trading hours, it surged to a session high of USD1,747.10 and retraced to the USD1,722.50 session low. From the price action, the selling pressure still persists on every intraday rebound. The bulls are also defending the support near the 20-day SMA line. As long as the COMEX Gold consolidates along the 20-day SMA line while not forming a lower low pattern, the counter-trend rebound stays intact. Hence, we make no change to our positive trading bias.

We recommend traders maintain long positions – this was initiated at USD1,729.20, or the closing level of 15 Mar. For risk-management purposes, the stop loss is set at USD1,717.

The immediate support maintained at 17 Mar’s low of USD1,724.10 and followed by 18 Mar’s USD1,719.10 low. Towards the upside, the nearest resistance is pegged at 23 Mar’s high of USD1,744.40 and followed by 18 Mar’s USD1,756 high.

Source: RHB Securities Research - 26 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024