Hang Seng Index Futures - Eyeing the 20-Day SMA Line

rhboskres

Publish date: Mon, 29 Mar 2021, 09:36 AM

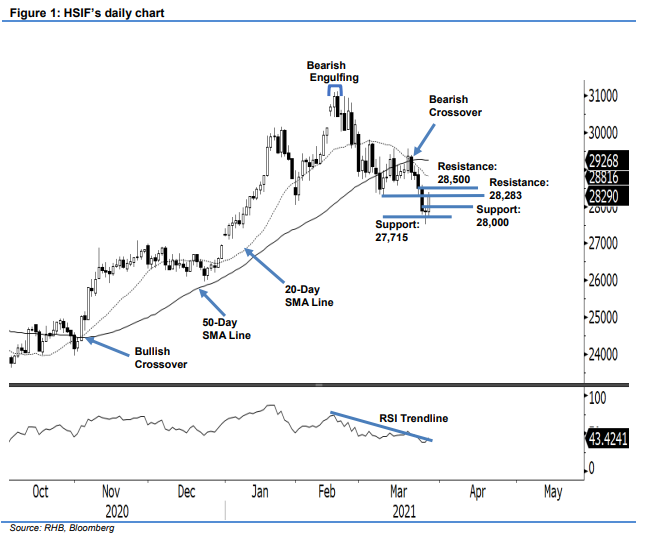

Maintain short positions. The HSIF saw strong bullish momentum last Friday, jumping 434 pts to settle at 28,290 pts. The index started the morning session flat at 27,949 pts. After touching a low of 27,932 pts, it rose to a high of 28,380 pts. The index then saw some profit-taking and retraced to close at 28,290 pts. During the evening session it dipped to close at 28,253 pts after retesting the session’s high of 28,327 pts. Given the strong momentum, the index may see further upside, moving closer to the month-end settlement. If it breaches the 28,500-pt level, it may trend higher to test the 20-day SMA line. On the other hand, a fall below 28,000 pts may dent sentiment, and see the re emergence of selling pressure. As we saw some selling pressure on Friday near 28,283 pts, and the stop-loss remains intact, we maintain our negative trading bias.

We recommend traders maintain the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop is placed at 28,300 pts.

The immediate support is revised to the 28,000-pt round figure, followed by 26 Mar’s low of 27,715 pts. Towards the upside, the immediate resistance is seen at 9 Mar’s low of 28,283 pts, followed by the 28,500-pt round figure.

Source: RHB Securities Research - 29 Mar 2021