E-Mini Dow - Bullish Momentum Resumes

rhboskres

Publish date: Mon, 29 Mar 2021, 09:37 AM

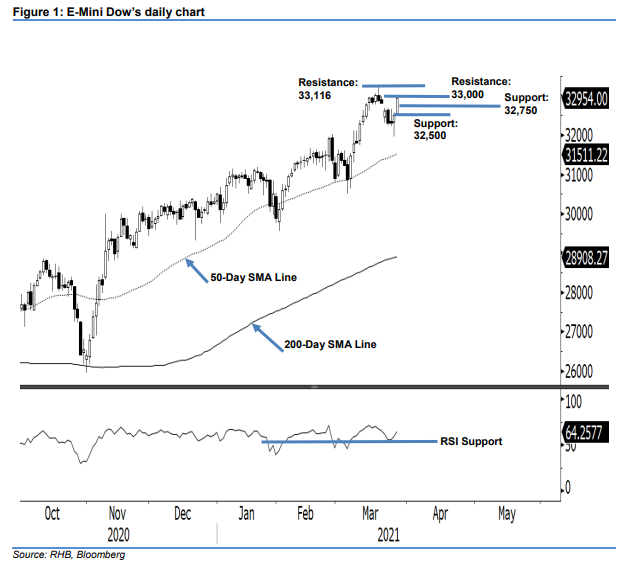

Maintain long positions. The E-Mini Dow saw momentum shift to the upside, surging 453 pts to settle at 32,954 pts. Last Friday, the index opened at 32,554 pts. After touching the session’s low of 32,496 pts, it soared to a high of 32,984 pts and was last traded at 32,954 pts – forming a white Marubozu candle. The price action showed that the bulls have overshadowed the bears. With the RSI indicator curving up, bullish momentum may lift the index to test the 33,000-pt immediate resistance level. If this psychological level is cleared, it may retest the all-time high of 33,116 pts. As the index moves higher, there may be some profit-taking by the bears. As long as the retracement is shallow, or sustains above 32,500 pts, the index will maintain its uptrend posture of “higher highs with higher lows”. Premised on this, we are keeping our positive trading bias.

We recommend traders stick to long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, the trailing-stop is revised to 32,500 pts.

The immediate support is revised to 32,750 pts, followed by 32,500 pts. On the upside, the immediate resistance is revised to the 33,000-pt psychological level, followed by the record high of 33,116 pts.

Source: RHB Securities Research - 29 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024