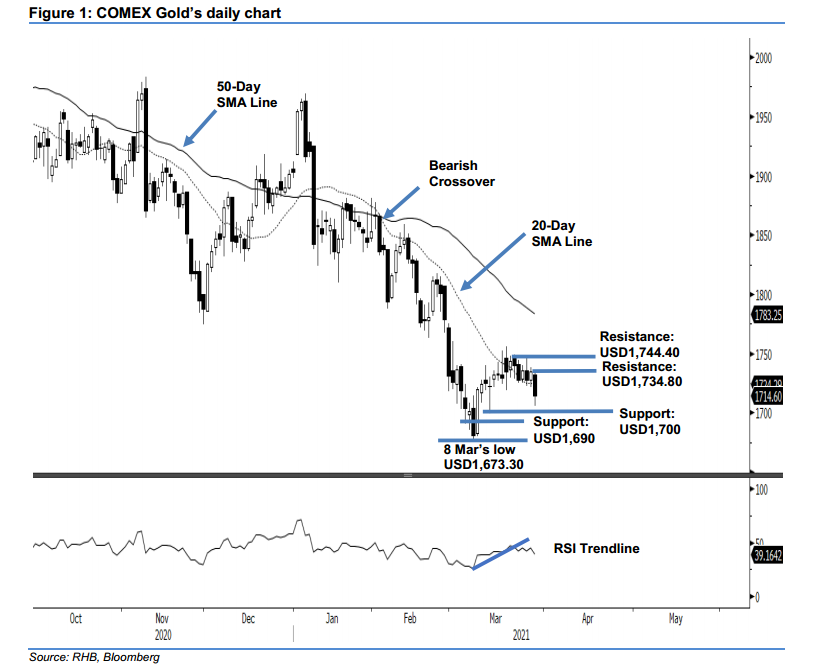

COMEX Gold - Breaching Below the 20-Day SMA Line

rhboskres

Publish date: Tue, 30 Mar 2021, 09:27 AM

Stop-loss triggered; initiate short positions. The COMEX Gold declined sharply by USD20.10 to settle at USD1,714.6. It started the Monday session at USD1,732.4. After tapping the session high of USD1,734.80, it drifted lower during the Asian trading hours. Moreover, during the latter part of the US trading hours, selling pressure heightened, which saw the commodity skid to the session’s low of USD1,705.6 – it settled below the 20- day SMA line. Since it breaches USD1,715, the COMEX Gold is reverting to a correction phase. If it breaches the psychological level of USD1,700, we may see a deeper correction ahead. Since the commodity has shifted to a negative momentum, we change to a negative trading bias.

We closed out the long positions, which were initiated at USD1,729.20, or the closing level of 15 Mar, after triggering the USD1,717 stop-loss level. Conversely, we initiate short positions at 29 Mar’s closing level. For riskmanagement purposes, the stop loss is set at USD1,744.40.

The immediate support is revised to USD1,700, followed by USD1,690. Towards the upside, the nearest resistance is pegged 29 Mar’s high of USD1,734.80 and followed by 23 Mar’s USD1,744.40 high.

Source: RHB Securities Research - 30 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024