WTI Crude - The Positive Momentum Continues

rhboskres

Publish date: Tue, 30 Mar 2021, 09:28 AM

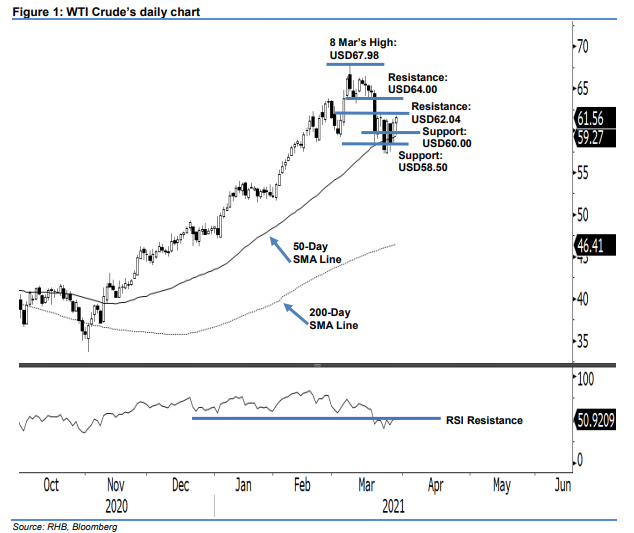

Stop-loss triggered; initiate long positions. The WTI Crude continued its positive momentum, crossing above USD61.00 – it rose USD0.59 to settle at USD61.56. After starting the session at USD60.93, it dipped to a low of USD59.41 and drifted sideways. During the European trading hours, it jumped to the session high of USD61.77, and stayed near the session high before last trading at USD61.56. The commodity managed to established an interim low at the 50-day SMA line and moved higher amid the positive momentum. As shown by the RSI indicator, the momentum is gaining traction, and this may propel the WTI Crude to test the immediate resistance pegged at USD62.04. A breakout above this resistance will see a “higher high” pattern forming. Since the commodity has breached our previous stop-loss level, we shift to a positive trading bias.

We closed out the short positions, which were initiated at USD60.06 – the closing level of 18 Mar – after triggering the stop loss at USD61.34. Conversely, we initiate long positions. To manage risks, the stop loss is placed at USD58.50.

The nearest support level is revised to the USD60.00 psychological level, followed by the USD58.50 round figure. On the upside, the immediate resistance is pegged at 22 Mar’s USD62.04 high and followed by USD64.00.

Source: RHB Securities Research - 30 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024