FCPO - Downtrend Has Legs

rhboskres

Publish date: Wed, 31 Mar 2021, 05:23 PM

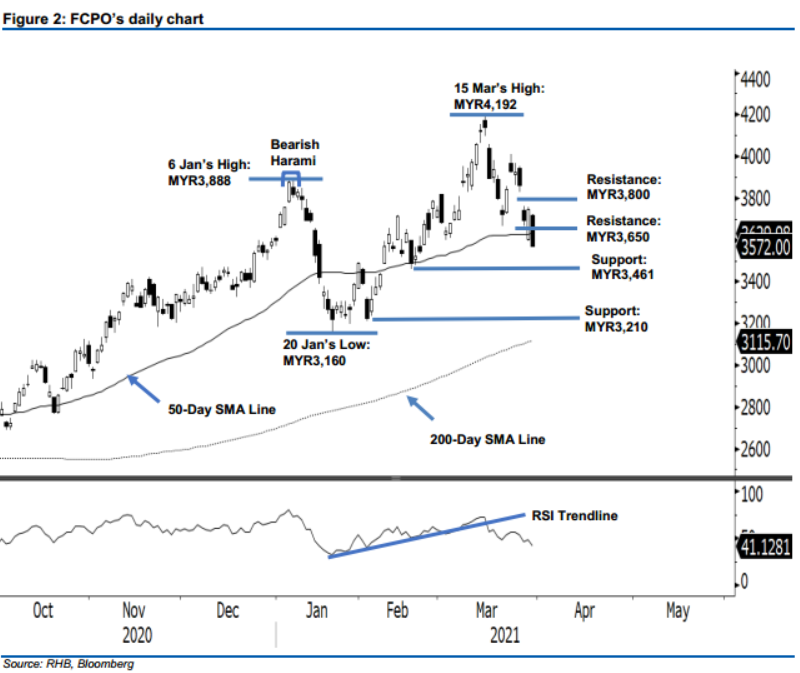

Maintain short positions. The FCPO underwent a sharp drop yesterday amid a long bearish candle, falling MYR175.00 to settle at MYR3,572. Initially, the commodity gapped downwards to open at MYR3,720. After briefly touching the day’s high of MYR3,721, it then skidded to the day’s low of MYR3,566, before closing – thereby neutralising the recent bullish momentum. The bears took action, and pulled the commodity to below the 50-day SMA line. This, together with the RSI pointing downwards, leads us to believe that the bearish momentum may follow through to test the support level of MYR3,461. Breaching below the level may see a deeper correction towards the next support level of MYR3,210. Unless the commodity reverses its current movement and rebounds towards MYR3,826, selling pressure may persist and the downside risks would remain in place. As such, we are maintaining a negative trading bias.

We recommend that traders maintain short positions, initiated at MYR3,692 or closing level of 26 Mar. To manage risks, traders can maintain a stop-loss at 25 Mar’s low of MYR3,826.

The immediate support is revised to 18 Feb’s low of MYR3,461, followed by 3 Feb’s low of MYR3,210. Towards the upside, the immediate resistance level is pegged at MYR3,650, followed by the psychological level of MYR3,800.

Source: RHB Securities Research - 31 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024