COMEX Gold - Regaining the USD1,700 Territory

rhboskres

Publish date: Thu, 01 Apr 2021, 05:06 PM

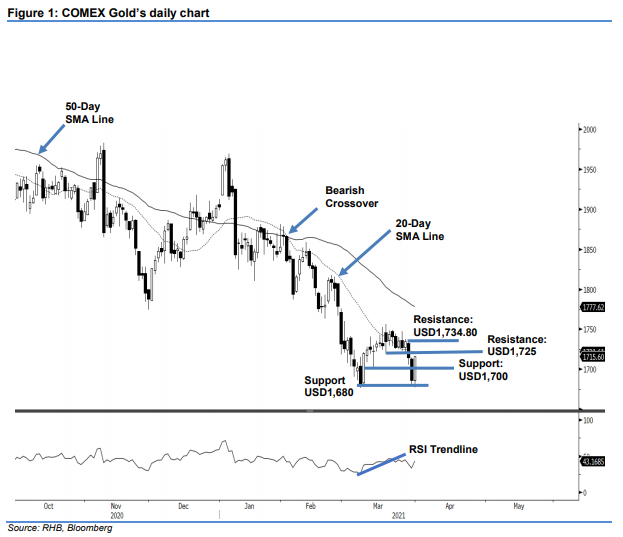

Stop-loss triggered; initiate long positions. The COMEX Gold saw renewed demand yesterday, jumping USD29.60 to settle at USD1,715.60 – regaining the USD1,700 ground. Following Tuesday’s sell-off, the precious metal started Wednesday’s session at USD1,685.90. After touching the session low of USD1,677.30, strong buying interest lifted it towards the USD1,716.30 session high – it last traded at USD1,715.60. This is the second time in 2021 that it managed to bounce off the USD1,700 psychological level. Since the bullish momentum has reversed the bearish sentiment, it is very likely that buying interest will persist, with the COMEX Gold trading between USD1,734.80 and USD1,680. As the stop loss is triggered, we shift to a positive trading bias.

We close out our previous short positions initiated at USD1,714.60 – 29 Mar’s closing level – after the stop loss was triggered. Conversely, we initiate long positions at the closing level of 31 Mar. For risk-management purposes, the stop-loss level is set at USD1,680.

The immediate support is revised to USD1,700 and followed by USD1,680. Towards the upside, the nearest resistance is pegged at USD1,725 and followed by 29 Mar’s high of USD1,734.80.

Source: RHB Securities Research - 1 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024