WTI Crude - Consolidating Near the 50-day SMA Line

rhboskres

Publish date: Thu, 01 Apr 2021, 05:07 PM

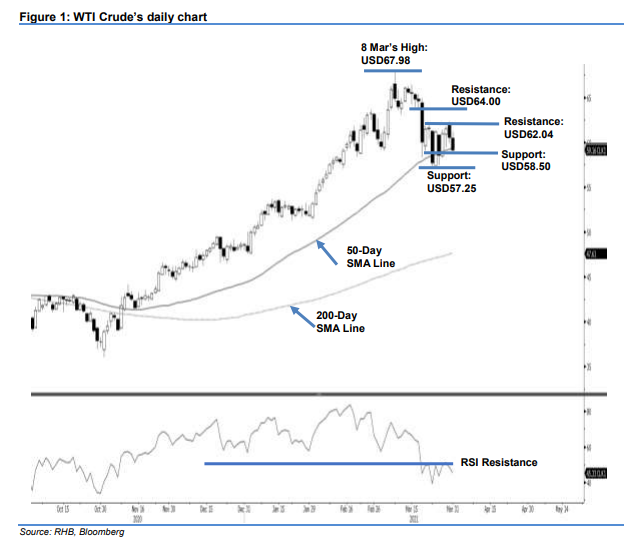

Maintain long positions. The WTI Crude saw profit-taking extend further yesterday, declining USD1.39 to settle at USD59.16. The commodity started the session at USD60.45, before tapping the session high of USD61.17. Mild selling pressure brought it to hit the session low at USD58.85 before it rebounded to settle at USD59.16. As long as the WTI Crude trades above the 50-day SMA line, there is a possibility of the momentum picking up post consolidation. As both the bulls and bears are waiting the outcome of the OPEC+ meeting slated for 1 Apr, it is likely that the black gold will move between a range of USD60.00 and USD62.04. A breakout of either band will see a new direction in the coming sessions. Meanwhile, we stick to our positive trading bias.

We recommend traders maintain long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop loss is placed at USD58.50.

The nearest support level is marked at USD58.50 and followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance is pegged at 22 Mar’s USD62.04 high and followed by USD64.00.

Source: RHB Securities Research - 1 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024