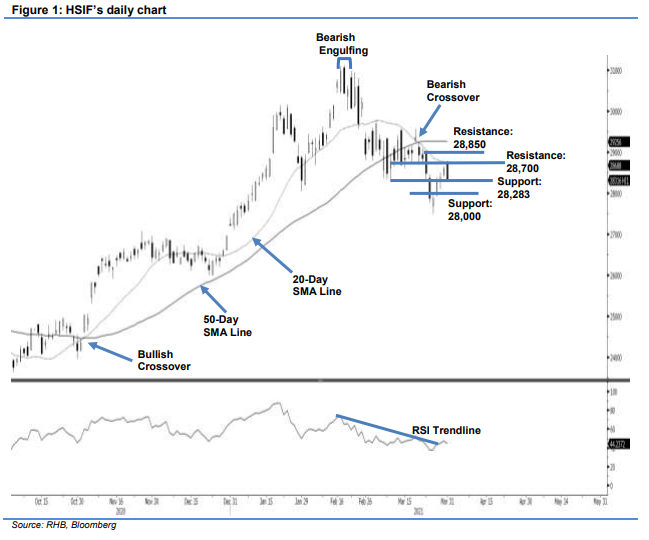

Hang Seng Index Futures - Consolidating Near the 20-Day SMA Line

rhboskres

Publish date: Thu, 01 Apr 2021, 05:12 PM

Maintain long positions. The HSIF saw a session of two halves yesterday, with the bears taking profit during the day while the bulls accumulated during the evening. The index started the day session at 28,752 pts. After registering the session high of 28,774 pts, it corrected to the 28,277-pt session low before settling at 28,316 pts. During the evening session, the HSIF recouped the day session’s losses and closed higher at 28,546 pts after testing the 28,565-pt session high. As mentioned in our previous note, the index is trending higher amid higher lows, so we think the counter-trend rebound phase remains intact. As long as the profit-taking activities do not breach the nearest low to form a lower low, the positive momentum should allow the HSIF to cross the 20-day SMA line. If this happens, the bulls may look to reach the 50-day SMA line. Premised on this, we stick to our positive trading bias.

We recommend traders maintain long positions, initiated at 28,385 pts, or the closing level of 29 Mar. For riskmanagement purposes, the stop loss is set at 28,000 pts.

The immediate support is marked at 9 Mar’s low of 28,283 pts and followed by the 28,000-pt round figure. Towards the upside, the immediate resistance is pegged at 28,700 pts and followed by the next hurdle: 28,850 pts.

Source: RHB Securities Research - 1 Apr 2021