FCPO - Bears Take a Breather

rhboskres

Publish date: Thu, 01 Apr 2021, 05:14 PM

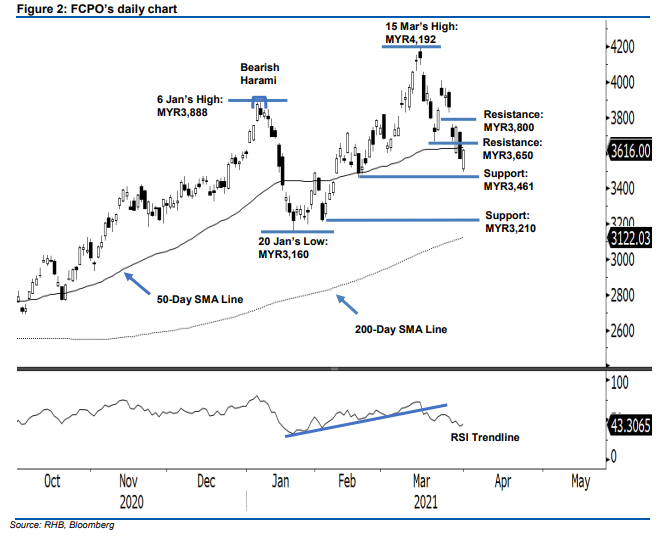

Maintain short positions. The FCPO saw the bulls attempting to stage a rebound yesterday, rising 40 pts to settle at MYR3,612. Initially, the commodity gapped downwards to open at MYR3,510. After briefly touching the day’s low of MYR3,495, it then drove north to the day’s high of MYR3,624 before settling in at MYR3,616 pts – a level that is below the 50-day SMA line. The bullish candle pierced into the previous bearish one, but failed to neutralise the previous bearish session – hence, the bearish momentum stays intact. Coupled with the RSI indicator moving downwards, this leads us to believe the bearish momentum may follow through to test the MYR3,461 support level. Breaching below this level may see a deeper correction towards the next support level of MYR3,210. Since the piercing pattern has yet to reverse the trend, we keep to our negative trading bias.

We recommend traders maintain short positions, which we initiated at MYR3,692, or the closing level of 26 Mar. To manage risks, a stop-loss level is placed at 25 Mar’s low of MYR3,826.

The immediate support stays at 18 Feb’s low of MYR3,461 – this is followed by 3 Feb’s low of MYR3,210. Towards the upside, the immediate resistance level is marked at MYR3,650 and followed by the MYR3,800 psychological level.

Source: RHB Securities Research - 1 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024