FKLI - Weak Rebound Points to Short Bull Run

rhboskres

Publish date: Mon, 05 Apr 2021, 08:48 AM

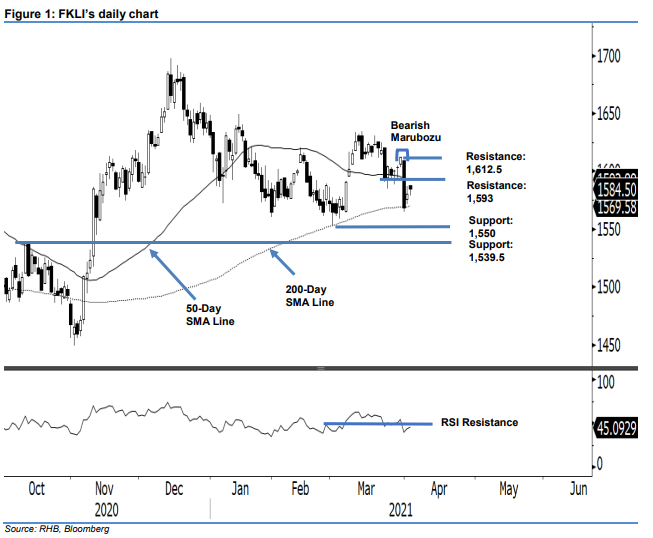

Maintain short positions. The FKLI climbed up slightly for two consecutive days after hitting the triple bottom, and closed 4.5 pts higher at 1,584.5 pts on Friday. The index opened at 1,588 pts to claim the day’s high. It then moved to the day’s low of 1,579 pts, before bouncing up to a close at a level that has not yet pushed above the 50-day SMA line. Although it gapped up at the opening, there was profit-taking or selling pressure. This, on top of the RSI indicator not having crossed above the 50% threshold, leads us to believe that the bullish momentum is weak. As the rebound did not trigger the previous stop-loss, the index remains in a “lower high” structure. We maintain a negative trading bias.

We recommend that traders stick to short positions, which were initiated at 1,593.5 pts or the close of 23 Mar. To manage risks, the stop-loss remains at 1,590 pts.

The support level stays at 26 Feb’s low of 1,550 pts, followed by 9 Oct 2020’s high of 1,539.5 pts. Towards the upside, the immediate resistance is revised to 29 Mar’s low of 1,593 pts, followed by 30 Mar’s high of 1,612.5 pts.

Source: RHB Securities Research - 5 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024