WTI Crude - Uptrend Posture Remains

rhboskres

Publish date: Mon, 05 Apr 2021, 08:59 AM

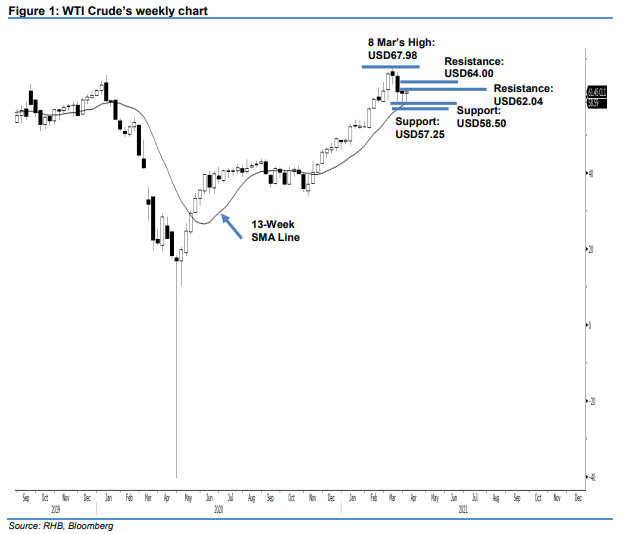

Maintain long positions. The WTI Crude has been riding on the 13-week SMA line, moving higher to settle at USD61.45. On the week that ended on 1 Apr, the commodity started at USD60.93 and traded between week’s low of USD58.85 and high of USD62.27, before ending at USD61.45. Based on the weekly chart, the uptrend started from the week of 13 Nov 2020, when it closed above the 13-week SMA line. Since then, strong buying interest has lifted it towards 2021’s high of USD67.98. In recent weeks, the commodity saw a pullback to retest the 13-week SMA line. As long as it manages to stay above the 13-week SMA line, it will still maintain its uptrend posture, exhibiting a “higher highs and higher lows” pattern. We maintain our positive trading bias.

We recommend traders stick to long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss is set at USD58.50.

The nearest support level is marked at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance is seen at 22 Mar’s USD62.04 high, followed by USD64.00.

Source: RHB Securities Research - 5 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024