E-Mini Dow - Retesting the All-Time High

rhboskres

Publish date: Mon, 05 Apr 2021, 09:01 AM

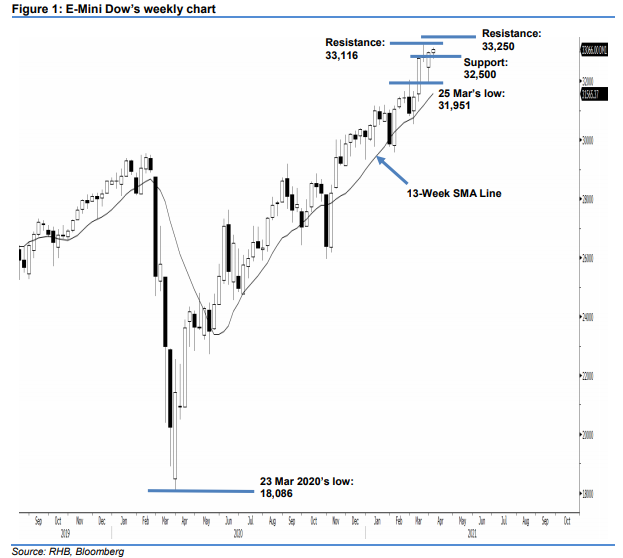

Maintain long positions. Based on the weekly chart, the E-Mini Dow moved up to settle at 33,037 pts, which is 79 pts away from 2021’s 33,116-pt high. Last week, the index attempted to retest its all-time high resistance level. It started the week at 32,951 pts and traded between the week’s high and low of 33,264 pts and 32,746 pts before settling at 33,037 pts. It concluded the week with a Spinning Top pattern, showing that the bulls and bears were indecisive, and that it is consolidating at the 33,000-pt psychological level before re-attempting to test 33,116 pts. The index may see some profit-taking and pullback in the coming sessions. As long as it stays above the 13-week SMA line, the major trend – a bullish structure – will remain intact. As such, we maintain our positive trading bias.

We recommend traders keep to the long positions initiated at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, the trailing-stop is set at 32,500 pts.

The immediate support remains at 32,750 pts, followed by 32,500 pts. On the upside, the immediate resistance is seen at 18 Mar’s high of 33,116 pts, followed by 33,250 pts.

Source: RHB Securities Research - 5 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024