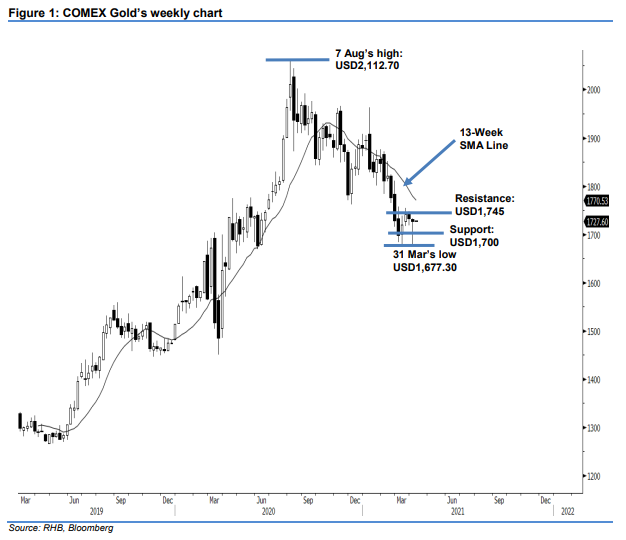

COMEX Gold - Building a Base Near USD1,700

rhboskres

Publish date: Mon, 05 Apr 2021, 09:02 AM

Maintain long positions. The COMEX Gold is building an interim base near the USD1,700 mark. Last week, the index started at USD1,732.40, but selling pressure dragged it towards the week’s low of USD1,677.30 before it rebounded to end the week at USD1,728.40 – forming a Hammer pattern. The bullish pattern indicates that there was strong buying interest near the USD1,700 support level. However, looking back at the past six months, the commodity has been following the 13-week SMA line to trend lower. If the USD1,700 psychological level gives way, downward movement may resume. However, if the yellow metal moves sideways and consolidates near the base, it may stage a counter-trend rebound towards the overhead resistance of the 13-week SMA line. With the commodity forming a base near USD1,700, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,715.60 on 31 Mar. For risk management purposes, the stop-loss is set at USD1,690.

The immediate support is marked at USD1,710 followed by USD1,700. Towards the upside, the nearest resistance is pegged at 29 Mar’s high of USD1,734.80, followed by USD1,745.

Source: RHB Securities Research - 5 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024