WTI Crude - A Pullback to the 50-Day SMA Line

rhboskres

Publish date: Tue, 06 Apr 2021, 08:39 AM

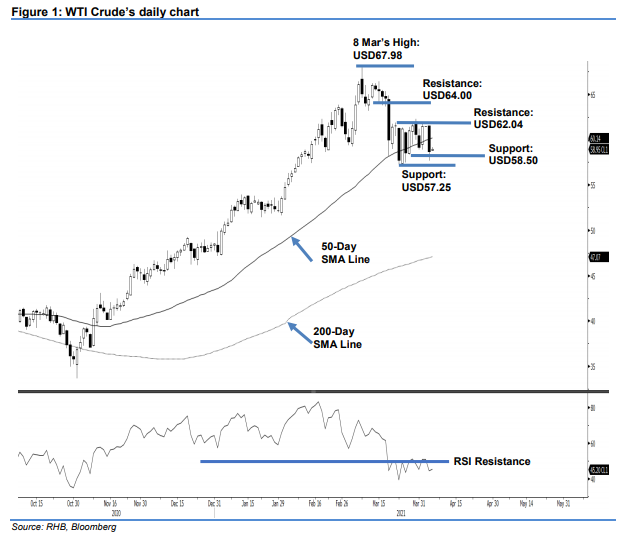

Maintain long positions. The WTI Crude saw bearish momentum emerge yesterday, falling USD2.80 to settle at USD58.65. The commodity started the session at USD61.50. Selling pressure dragged it to a low of USD57.63 before it settled at USD58.65 – a level below the 50-day SMA line. Observe that the RSI is falling below the 50% threshold, indicating that the commodity will see whipsaw movement ahead. If it stays above USD58.50, it will still exhibit a “higher low” formation, and the uptrend will remain intact. There is a possibility of the index retesting the 50-day SMA line to resume upward movement. We keep our positive trading bias until the stop-loss is breached.

We recommend traders stick to long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss is placed at USD58.50.

The nearest support level remains at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance is seen at 22 Mar’s USD62.04 high, followed by USD64.00.

Source: RHB Securities Research - 6 Apr 2021