Hang Seng Index Futures - Testing the 29,000-Pt Level

rhboskres

Publish date: Wed, 07 Apr 2021, 04:40 PM

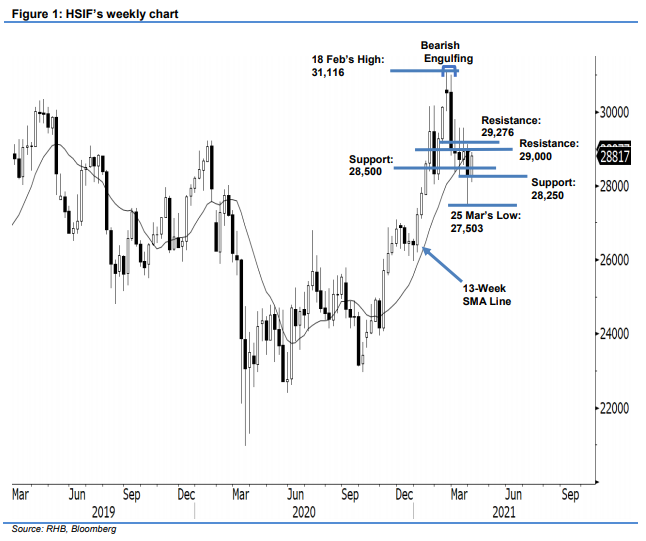

Maintain long positions. Based on the weekly chart, the HSIF saw bullish price action, rebounding to settle at 28,817 pts. After crossing above the 13-week SMA line on 2 Nov 2020, the index has been moving higher, recording a multi-week high of 31,116 pts on 18 Feb. Since then, it saw a Bearish Engulfing pattern, with the correction dragging it towards 25 Mar’s 27,503-pt low, and ending with a long lower shadow candlestick pattern. With the recent positive price actions, the index is poised to retest the overhead resistance of the 13-week SMA line. A breach above the 29,000-pt level will see bullish momentum extend further, or at least towards the 29,276-pt level. A fall below 28,250 pts may see it revert to downward movement. As the index is moving higher on bullish momentum, we stick to our positive trading bias.

We recommend traders keep the long positions initiated at 28,385 pts, or the closing level of 29 Mar. For risk management purposes, the stop-loss is set at 28,250 pts.

The immediate support is marked at the 28,500-pt round figure, followed by 28,250 pts. Towards the upside, the immediate resistance is pegged at the 29,000-pt round figure, followed by the next hurdle at 29,276 pts.

Source: RHB Securities Research - 7 Apr 2021