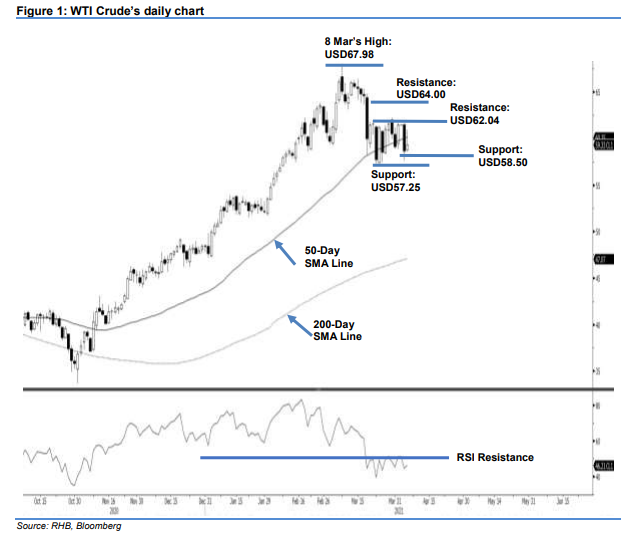

WTI Crude - Consolidating Below the 50-Day SMA Line

rhboskres

Publish date: Wed, 07 Apr 2021, 04:57 PM

Maintain long positions. The WTI Crude attempted to climb above the 50-day SMA line, rising USD0.68 to settle at USD59.33. Following Monday’s bearish session, it started Tuesday’s session stronger at USD58.80. It traded at the low of USD58.62 before climbing towards the high of USD60.90. However, the bears took profit, resulting in the commodity paring its earlier gains to settle at USD59.33. The rebound was capped by the 50-day SMA line. As the RSI is struggling below the 50% threshold, the black gold will see weak momentum ahead. A breach of the USD58.50 level may see the formation of a “lower low” pattern, and resumption of downward movement. Until then, there is a possibility that the commodity will reclaim the 50-day SMA line in coming sessions, and therefore, we are keeping our positive trading bias.

We recommend traders maintain long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss is set at USD58.50.

The nearest support level is unchanged at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance is pegged at 22 Mar’s USD62.04 high, followed by USD64.00.

Source: RHB Securities Research - 7 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024