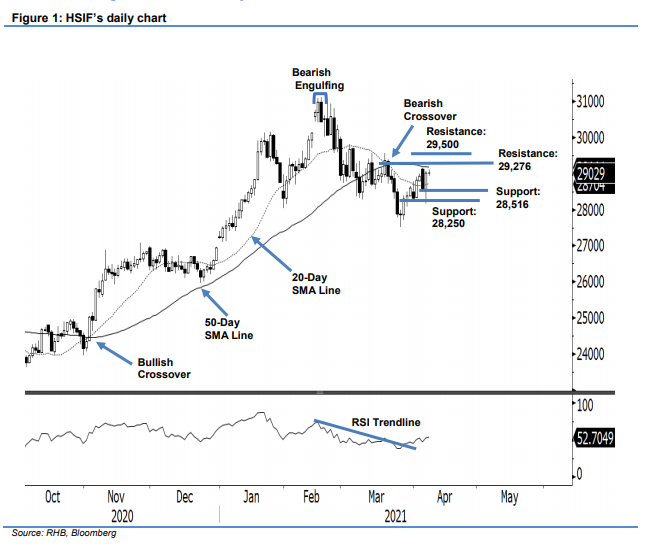

Hang Seng Index Futures - Consolidating Near the 20-Day SMA Line

rhboskres

Publish date: Fri, 09 Apr 2021, 04:24 PM

Maintain long positions. The HSIF saw bullish momentum emerging, rising 482 pts to end the day session at 29,023 pts – erasing the bearish momentum of the previous session. During Thursday’s session, the index gapped up to open at 28,416 pts. After touching the session low of 28,371 pts, it surged to the 29,055-pt session high. Mild profit-taking was seen during the evening session, where the HSIF closed at 28,974 pts after retracing from the 29,094-pt session high. If the index manages to trade and sustain above the critical level of 29,000 pts, it may move north to test the overhead reistance near the 50-day SMA line. Meanwhile, if profit-taking activities by the bears extend, the HSIF may retrace lower to consolidate near the 20-day SMA line. As long as the stop-loss stays intact, we maintain our positive trading bias.

We recommend traders stay in long positions, which were initiated at 28,385 pts, or the closing level of 29 Mar. For risk-management purposes, the stop loss is set at 28,250 pts.

The immediate support is revised to 7 Apr’s low of 28,516 pts and followed by 28,250 pts. Meanwhile, the immediate resistance is pegged at 11 Mar’s closing level of 29,276 pts, followed by the next hurlde at the 29,500-pt round figure.

Source: RHB Securities Research - 9 Apr 2021