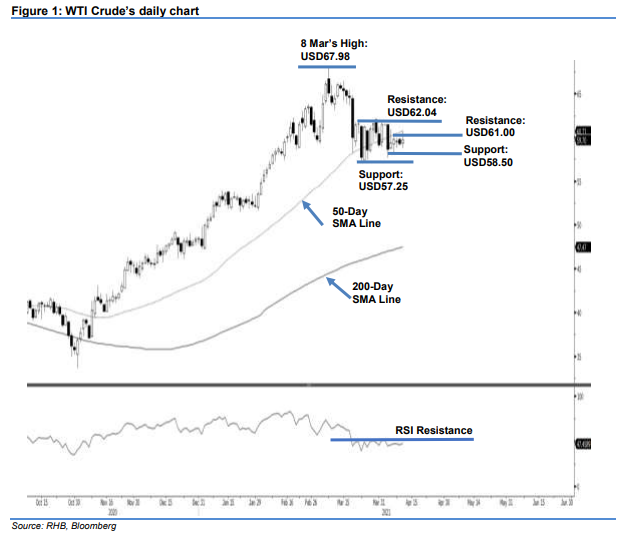

WTI Crude - Attempting to Cross the 50-Day SMA Line

rhboskres

Publish date: Tue, 13 Apr 2021, 09:29 AM

Maintain long positions. The WTI Crude attempted to stage a rebound, rising USD0.38 to settle at USD59.70. It started Monday’s session at USD59.35. After sliding towards the session’s low of USD58.73, brief buying interest sent prices higher towards the high of USD60.77. It was last traded at USD59.63. While still capped by sideways movement, the bulls are looking to cross the 50-day SMA line. A breach above the USD61.00 level may ignite bullish momentum to propel it above the 50-day SMA line. Meanwhile, a breach below the support level of USD58.50 may see downside risks. As the stop-loss remains intact, we maintain our positive trading bias.

We recommend traders keep to long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss is set at USD58.50.

The nearest support level is unchanged at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance remains at the USD61.00 round figure, followed by 22 Mar’s USD62.04 high.

Source: RHB Securities Research - 13 Apr 2021