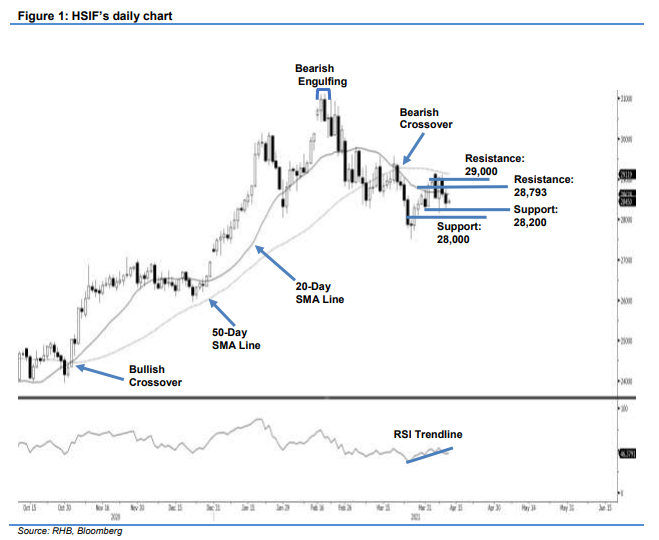

Hang Seng Index Futures - Falling Below the 20-Day SMA Line

rhboskres

Publish date: Tue, 13 Apr 2021, 09:30 AM

Trailing-stop triggered; Initiate short positions. The HSIF saw selling pressure continue yesterday, declining 221 pts to settle at 28,413 pts – below the 20-day SMA line. It started the day at 28,550 pts, and ffter testing the session’s high of 28,793 pts, it slipped to the 28,223-pt low. During the evening session, the HSIF recouped its losses to close at 28,450 pts, after rebounding to a 28,501-pt high. Trading below the 20-day SMA line may drag the moving average lower. If the 20- and 50-day SMA lines revert to pointing lower, the index may see negative momentum or selling pressure accelerate. As the trailing-stop was breached, we shift to a negative trading bias.

We close out the long positions initiated at 28,385 pts, or the closing level of 29 Mar, after the trailing-stop was triggered at 28,470 pts. Conversely, we initiate short positions at the closing level of 12 Apr, or 28,411 pts. For risk management purposes, the initial stop-loss is set at 29,050 pts.

The immediate support is revised to the round figure of 28,200 pts, followed by 28,000 pts. The immediate resistance is pegged at 12 Apr’s high of 28,793 pts, followed by the psychological level of 29,000 pts.

Source: RHB Securities Research - 13 Apr 2021

.png)