WTI Crude - Blocked by USD64.00

rhboskres

Publish date: Wed, 21 Apr 2021, 05:01 PM

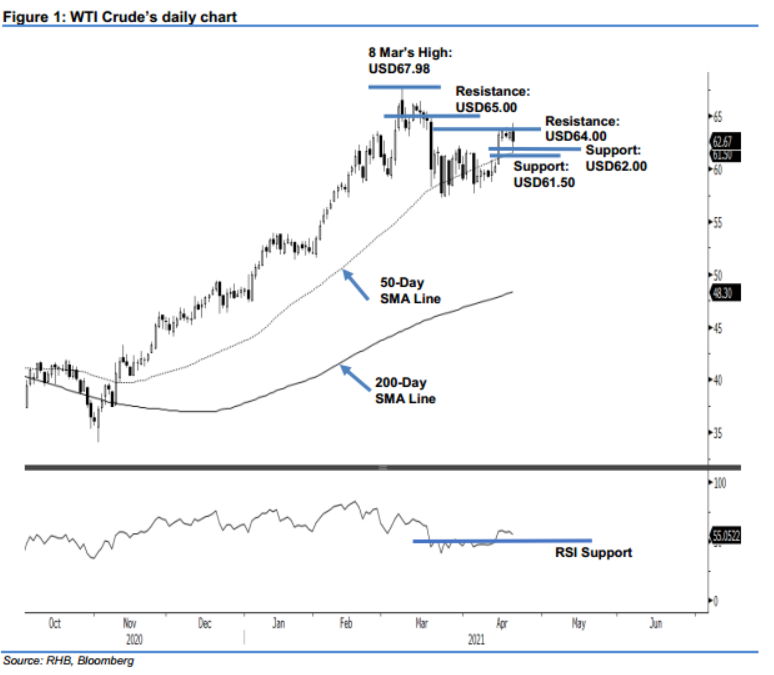

Maintain long positions. The WTI Crude Jun 2021 futures contract failed to cross the upside resistance of USD64.00, retracing USD0.76 to settle at USD62.67. It started Tuesday’s session stronger at USD63.53 and crossed USD64.00 to touch the intraday high of USD64.38. However, it failed to hold on to the gains, and fell to the day’s low of USD61.49, ending the day at USD62.67. We believe this is a blessing in disguise as the commodity has reacted positively to the 50-day SMA line, with buying interest emerging near the support range of USD62.00 to USD61.50. As long as it stays above the 50-day SMA line, it may consolidate sideways and retest the USD64.00 level again in the coming sessions. Hence, we maintain our positive trading bias.

We suggest traders stick to long positions initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop loss is placed at the breakeven point - USD61.56.

The nearest support level is at USD62.00, followed by USD61.50. Towards the upside, the immediate resistance sighted at USD64.00, followed by USD65.00.

Source: RHB Securities Research - 21 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024