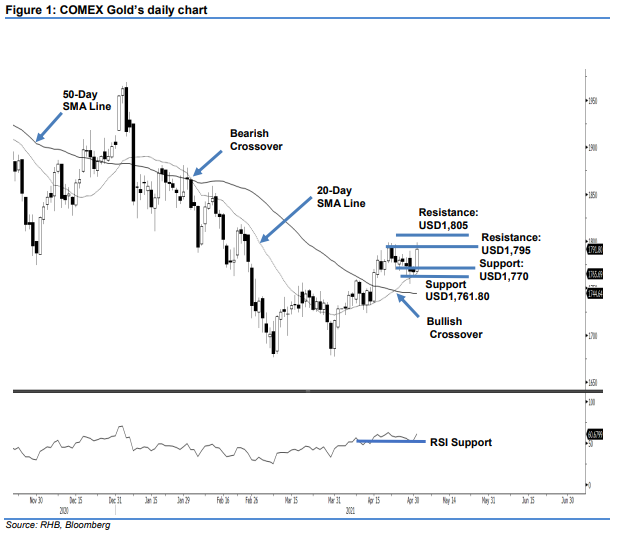

COMEX Gold - Bouncing Off the 20-Day SMA Line

rhboskres

Publish date: Tue, 04 May 2021, 09:11 AM

Stop-loss triggered; initiate long positions. The COMEX Gold, lifted by strong buying interest yesterday, jumped USD24.10 to settle at USD1,791.80. After starting the session at USD1,768.10, it edged higher until reaching the USD1,798.9 day high. Mild profit-taking then sent the COMEX Gold lower to close at USD1,791.80. From the price action, we saw strong support established between USD1,770 and USD1,761.80. Coupled with the 20-day SMA line trending higher, it may attempt to test the USD1,805 upside resistance or, at least, the nearest resistance at USD1,795. Before that happens, mild consolidation may take place – pending the 50-day SMA line curving higher. Since the rebound has breached the stop loss, we shift to a positive trading bias.

We closed out the short positions initiated at 29 Apr’s – or the close of USD1,768.30 – after triggering the stop loss at USD1,790. Conversely, we initiate long positions at the closing level of 3 May, ie USD1,791.80. For riskmanagement purposes, the initial stop-loss threshold is set at USD1,760.

The immediate support is revised to USD1,770 and followed by 28 Apr’s low of USD1,761.80. Towards the upside, the nearest resistance is pegged at USD1,795 and followed by the USD1,805 whole number.

Source: RHB Securities Research - 4 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024