FKLI - Moving Higher Above The 200-day SMA Line

rhboskres

Publish date: Wed, 19 May 2021, 09:11 AM

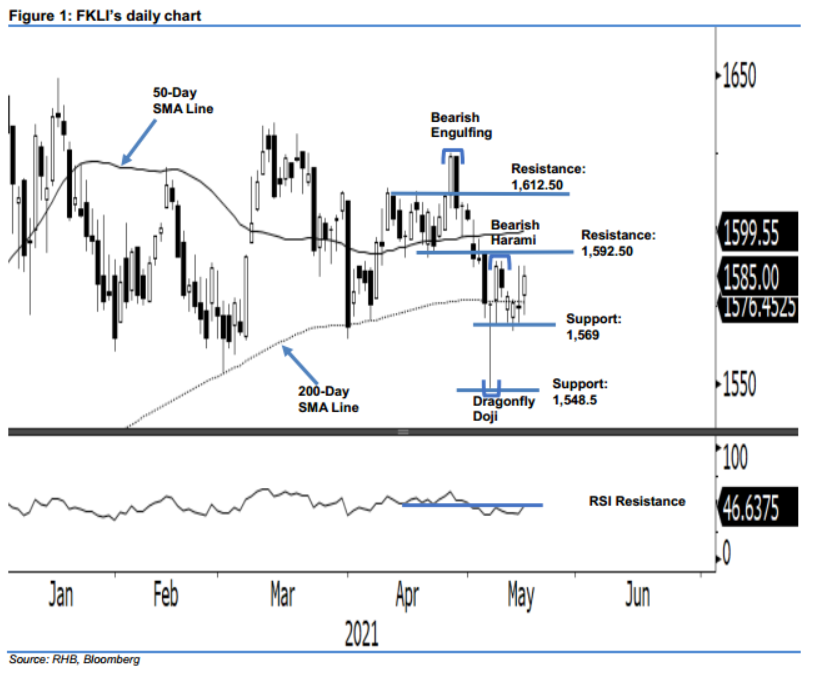

Maintain long positions. The FKLI managed to climb back above the long-term average line by surging 10.5 pts to close at 1,585 pts yesterday. The index opened higher after which it oscillated between 1,572 pts and 1,588 pts prior to the strong closing. The positive momentum yesterday signifies a bullish bias above the 200-day SMA line, which may drive the index towards the immediate resistance level in the immediate term. If the index manages to break above the immediate resistance level, a higher high pattern may emerge – indicating a bullish momentum in the medium term. As such, we stick to our positive trading bias.

Traders should stay long positions. We initiated these at 1,588 pts, which was also the closing level of 7 May. To reduce risks, the stop-loss is pegged below 1,569 pts, or 7 May’s low.

The support levels are set at 1,569 pts – 7 May’s low, and subsequently at 1,548.5 pts, which is 6 May’s low. On the upside, the resistance levels are fixed at 1,592.50 pts – 5 May’s high, and 1,612.5 pts, which is 30 Mar’s high.

Source: RHB Securities Research - 19 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024