COMEX Gold - Maintaining a Bullish Posture

rhboskres

Publish date: Wed, 19 May 2021, 09:11 AM

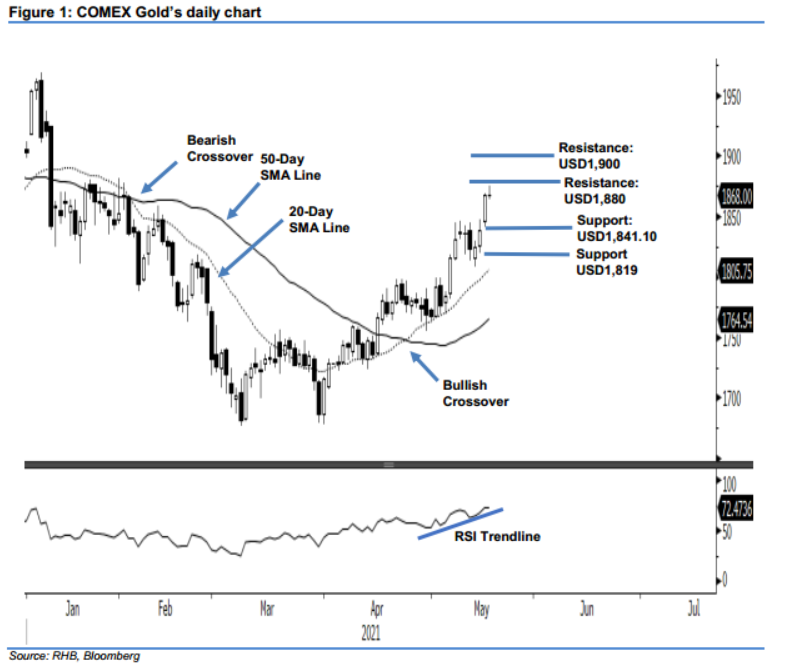

Maintain long positions. Despite mild profit-taking taking place near the 3-month high, the COMEX Gold managed to add USD0.40 to settle at USD1,868. It opened at USD1,867.30, rising to the USD1,875.90 session high before retreating to the session low of USD1,863.50 – the commodity closed at USD1,868, forming a Doji pattern. Although the bullish momentum softened, the COMEX Gold still recorded a “higher high”, reaffirming the bullish structure. While we do not discount the possibility of extended profit-taking in the coming sessions, buying pressure should emerge near the USD1,841.10 support level. As long as the trailing stop stays intact, we should see another “higher low” bullish pattern forming in the coming sessions. Hence, we keep our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,791.80, or the closing level of 3 May. For risk-management purposes, the trailing-stop threshold is raised to USD1,825.

The immediate support is marked at USD1,841.10 – the low of 17 May – and followed by USD1,819, or the low of 14 May. Towards the upside, the nearest resistance is pegged at USD1,880, followed by USD1,900.

Source: RHB Securities Research - 19 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024