FCPO - Bullish Momentum Re-Emerges

rhboskres

Publish date: Wed, 19 May 2021, 09:11 AM

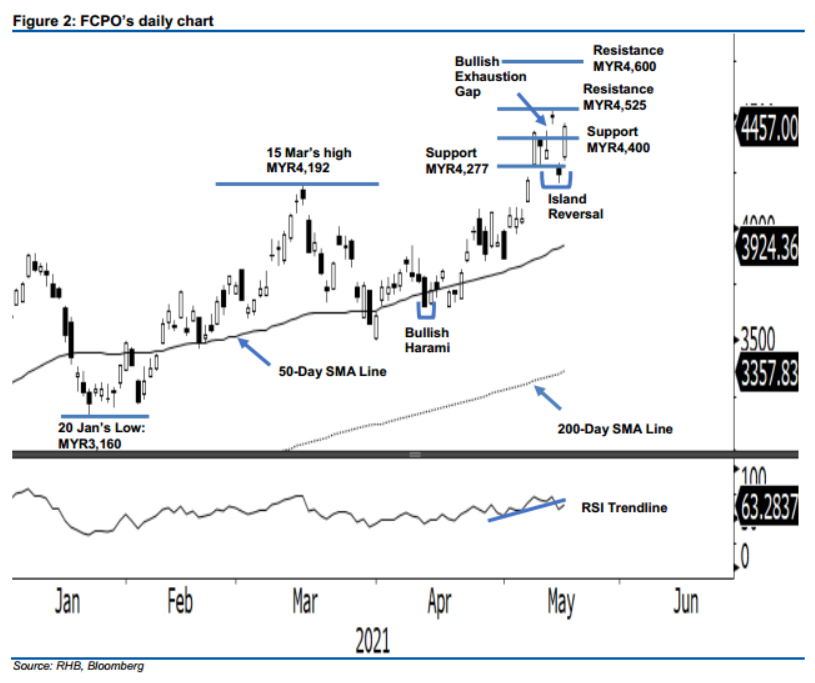

Trailing stop triggers; initiate long positions. The FCPO saw a directional reversal with a gap up forming an “Island Reversal” pattern, breaking above the trailing-stop level to close MYR215 stronger yesterday. The commodity started the session with a gap up at MYR4,320, and tapped the day’s low of MYR4,300 before changing to a positive direction towards the day’s high of MYR4,468 and closing at MYR4,457. Contrary to the previous day’s gap down, the commodity showed strong positive momentum yesterday, offsetting the bearish momentum. With this, buying pressure is seen to be coming back, which draws an expectation for the bullish momentum to continue in the upcoming sessions. Since the stop loss has been triggered, we change from a negative to positive trading bias.

We closed out the short positions, which were initiated at the close of 17 May at MYR4,242, after triggering the stop loss at MYR4,400. Conversely, we initiate long positions at the closing level of 18 May at MYR4,457. To manage risks, a stop loss can be placed below the next support level of MYR4,277.

The immediate support level is revised at MYR4,400, followed by MYR4,277 or 7 May’s low. Towards the upside, the resistance levels are changed at 12 May’s high of MYR4,525, and subsequently MYR4,600 – the psychological level.

Source: RHB Securities Research - 19 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024