COMEX Gold - Still Consolidating Horizontally

rhboskres

Publish date: Fri, 25 Jun 2021, 05:31 PM

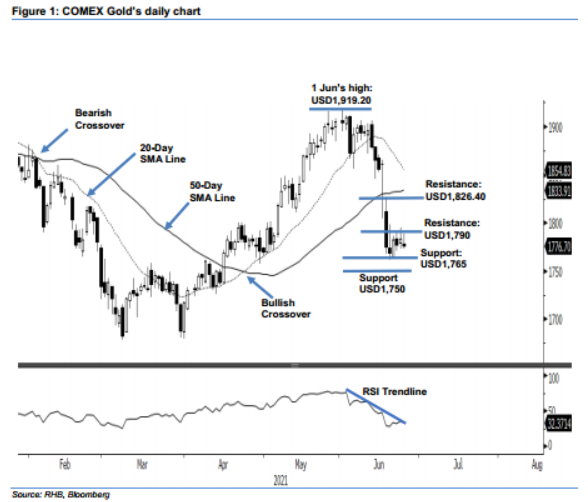

Maintain short positions. In a bearish session yesterday, the COMEX Gold gave up Wednesday’s gains, declining USD6.70 to settle at USD1,776.70. It initially started Thursday’s session weaker at USD1,778.20. It then slipped to the day’s low of USD1,772.70 before rebounding to test the day’s high of USD1,788.60. The bullish momentum failed to hold, and the precious metal retraced towards the day’s low again before closing at USD1,776.70. Coming to the end of the week, the USD1,790 resistance level proved too strong for the commodity. It may need to retrace lower for further consolidation before it can test the resistance level again. A breach of the USD1,765 immediate support level may see the next possible support at USD1,750. With the RSI still trending lower – indicating a weak momentum in play – we keep our negative trading bias.

Traders are advised to maintain the short positions initiated at USD1,873.30, or the closing level of 3 Jun. For risk management, the trailing-stop threshold is set at USD1,790.

The immediate support remains at USD1,765, followed by the USD1,750 round figure. The immediate resistance is pegged at USD1,790, and followed by USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 25 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024