COMEX Gold - Bullish Momentum Is Growing

rhboskres

Publish date: Tue, 06 Jul 2021, 09:55 AM

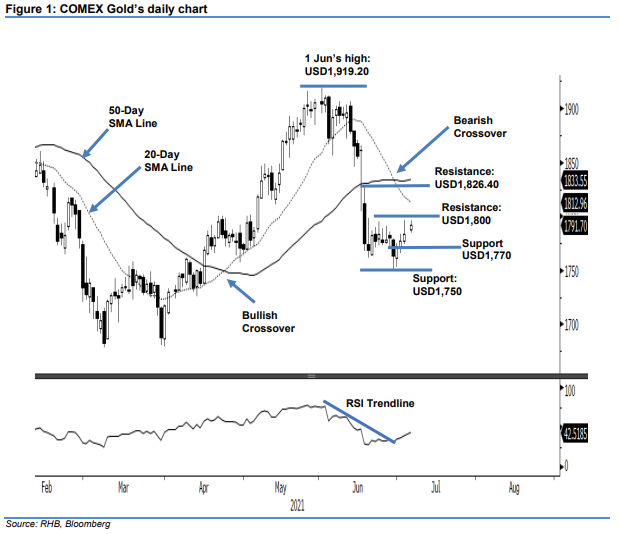

Maintain short positions. Last Friday, the COMEX Gold attempted to break above the USD1,790 resistance level, but the momentum was not strong enough to breach the threshold, settling at USD1,783.30. At recent session, it climbed above the USD1,790 resistance level again, touching USD1,791.70 at the time of writing. We observe that the RSI has breached the trendline, indicating that bullish momentum is gaining traction. Furthermore, based on the last few sessions’ price actions, support has formed firmly at the USD1,750 level. We think the selling pressure is subsiding, and the bulls are taking control. Despite the positive price action, the latest session is still in progress and not yet settled. Hence, we will hold on the short positions and maintain bearish bias.

We stick to the short positions initiated at USD1,873.30, or the closing level of 3 Jun. To manage risks, the stoploss is set at USD1,790.

The immediate support is adjusted to USD1,770, followed by the USD1,750 round figure. Meanwhile, the nearest resistance is projected at the USD1,800 psychological level, and the higher hurdle at USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 6 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024